Chances are, you know where your nearest plastic, glass or paper recycling drop-off is. But do you know where to take your e-waste?

Mobile phones, laptops, appliances, printers, printer cartridges, cameras, TVs, solar panels, vending machines, light bulbs, batteries, lamps, medical devices, electronic toys… They all need to reach specialised recycling facilities at the end of their lifespan, or they’ll likely end up in a landfill, leaking heavy metals and other toxic substances into the environment. E-waste is not biodegradable and accumulates in the environment. In informal settings, open-air burning and acid baths are used to recover valuable materials from electronic components, releasing further toxic materials into the environment and harming human health.

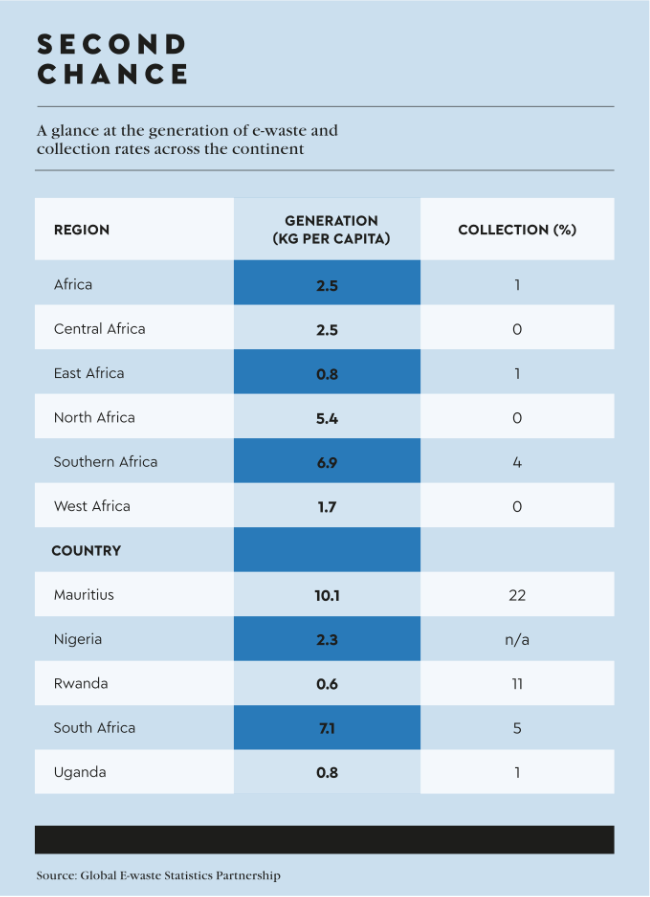

According to the UN’s most recent Global E-waste Monitor, approximately 53.6 million tons of e-waste was generated in 2019. Africa alone creates 2.9 million tons of e-waste every year, yet just 1% is formally documented to be collected or recycled. The monitor predicts that global e-waste will reach 74 million tons by 2030, almost doubling in just 16 years, making e-waste the world’s fastest-growing domestic waste stream. ‘Only 17.4% of 2019’s [global] e-waste was collected and recycled,’ states the report. ‘This means that gold, silver, copper, platinum and other high-value, recoverable materials conservatively valued at US$57 billion – a sum greater than the gross domestic product of most countries – were mostly dumped or burnt rather than being collected for treatment and reuse.’

Unlike the plastics and paper/pulp industries, recycling of South Africa’s electronic waste is ‘in a state of infancy’, according to Ashley du Plooy, CEO of the Ewaste Recycling Authority (ERA), an NPC.

Africa has the lowest levels of e-waste recycling globally (about 0.9%) compared to Europe (around 42.5%) and Asia (11.7%), the Americas (9.4%) and Oceana (8.8%), but the UN has acknowledged that Africa is pioneering ways of reducing e-waste through policy, regulation and legislation.

In South Africa, Extended Producer Responsibility (EPR) regulations came into effect in November 2021, making it illegal to dump or dispose of waste electrical and electronic equipment (WEEE) to landfill. Any company that produces or imports electrical and electronic equipment (EEE) has to partner with a licensed recycler, such as the ERA, to ensure that it has a plan for the life cycle of its products. This is a significant step towards creating a circular e-waste economy. ‘When properly managed, WEEE can produce economic benefits and result in the mitigation of the worst effects of discarded low- or negative-value materials,’ says Du Plooy. ‘In addition, properly managed “mining” of WEEE can mitigate the impact of mining on the climate, health and the environment in general.’

Electronic waste is one of the most complicated forms of waste to recycle, because many different materials are used to make electronic items, and they require different recycling treatments – if they are recyclable at all.

‘We will only be able to establish how much of our e-waste is recyclable after we achieve the implementation of life cycle assessments for all products or categories of EEE product,’ says Du Plooy. ‘Producers and their PROs [producer responsibility organisations] have been given a five-year period in which to establish the parameters and implement life-cycle assessments. This is a challenging exercise globally. There is much work and consultation to be done to determine this. I would hazard a guess, based on discussions with WEEE recyclers, that the high-value fraction [the ratio of various components and materials in electronic goods] of e-waste is considerably lower than the low- or negative-value fractions emanating from e-waste.

‘More informed estimates will only derive from large-scale research capacity and good data deposits and analysis, which we currently don’t have readily available.’

While PROs are hopeful that the new regulations will stimulate the growth of e-waste management systems, recycling infrastructure and behaviour modification, the challenge of implementing sound governance and measuring outcomes is not insignificant. As Du Plooy says, there is no reliable data repository for WEEE recycling in South Africa, so close monitoring of recyclers’ processes and outcomes is essential.

While it’s too early to tell how big an impact EPR regulations will have, there’s no denying they are a big step in the right direction.

‘The EPRs have had a positive effect in that there is now a “level playing field” supported by legislation,’ says Keith Anderson, CEO of the EPR Waste Association of South Africa (eWASA), a PRO. In other words, all electronic companies are bound by the same requirements. ‘Everybody must play by the same rules. This has translated into more activity, improved standards, training and so on. We are only beginning to see a picture of the impact after the first year of EPR schemes in the country.’

Sadly, he adds, a number of companies that are obligated to comply with the new EPR regulations are not doing so, despite facing severe penalties.

‘You can have the best legislation in the world, but if it’s not even enforced, it’s absolutely meaningless,’ says Anderson. ‘Furthermore, as per the regulations, eWASA is obligated to report to the Department of Forestries, Fisheries and the Environment on any entity that we believe is not complying.’

The PRO assists producers and retailers of EEE, lighting and associated packaging materials – including Pick n Pay, L’Oréal, Massmart, Foschini Retail Group, Canon, Volkswagen, Samsung and British American Tobacco South Africa – in managing their e-waste streams effectively. ‘As such, we certainly have to increase our awareness and education efforts.’

Anderson singles out Samsung as one company that has embraced the regulations in the right spirit. ‘Samsung are very responsible. They pay a huge amount of money in EPR fees, because of all the products that they put on market.’

Samsung South Africa has implemented a popular trade-in programme in which more than 6 000 Samsung and non-Samsung eligible devices, such as laptops, mobile phones, smartwatches, tablets and many more, can be handed in at Samsung stores and responsibly disposed of.

Samsung’s repair or replacement process is designed so that electronic components and products are collected, checked, recorded and stored at Samsung warehouses. Identified e-waste is pre-scrapped to ensure no unauthorised reuse in substandard repairs and irresponsible disposal thereof. Waste is collated weekly or monthly, after which Samsung’s authorised recycling and scrapping partners collect all waste, recycle and dispose of the materials in the prescribed processes to minimise waste to landfill. Finally, a scrapping certificate is issued by the partner as guarantee that material is responsibly disposed of.

The company has also made a considerable investment in black women-owned e-waste recycling businesses, two of which were recently selected as part of its ZAR280 million Equity Equivalent Investment programme.

The growth of WEEE management in South Africa is going to depend largely on three factors, according to Du Plooy.

Firstly, the extent that EEE producers comply with the EPR regulations and pay appropriate EPR levies to develop the required WEEE management infrastructure and systems. Secondly, the degree to which South Africa’s government proactively and publicly sanctions non-compliant EEE producers. And thirdly, the capacity of government to monitor and control the WEEE recycling sector.

‘Ultimately, I see the growth in the future of the WEEE recycling industry in South Africa, with increasing collaboration across the African continent,’ says Du Plooy.

‘It will be important at this early stage, however, to ensure that no unwarranted distortions and perversion creep into the roll-out of EPR, which could render it unsustainable and lead to the collapse of the early gains which we anticipate from the new legal environment for WEEE producers and recyclers.’