Help is at hand for small enterprises in South Africa struggling to keep the lights on and their businesses operational during load shedding.

Local financing company Business Partners has set up a ZAR400 million energy fund specifically geared towards SMEs that don’t have the means to invest in alternative energy sources, reports Bizcommunity.

Entrepreneurs will be able to access loans of between ZAR250 000 and ZAR2 million at a competitive, risk-adjusted interest rate. Successful applicants will have a grace period of six months before the loan has to be repaid. The repayment term is for up to five years.

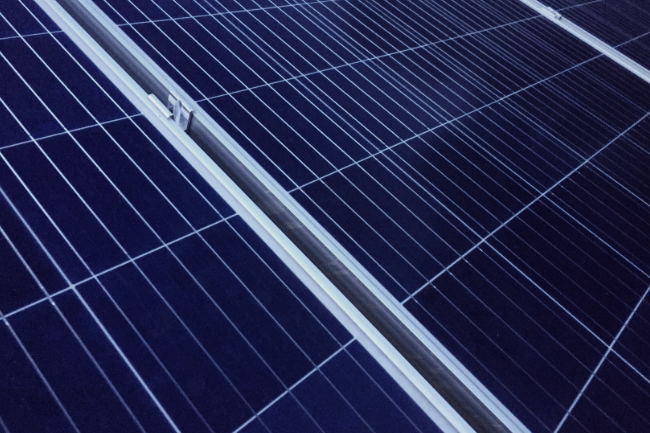

The loan will allow SMEs to invest in solar power systems, back-up batteries, inverters, diesel generators and other power mitigation measures.

‘With alternative energy sources, businesses can future-proof their operations, position themselves as potential contributors to the impending embedded generation programme while also reducing the cost of energy,’ says Jeremy Lang, executive director and chief investment officer at Business Partners.