According to a Global Market Insights study, issued last October, the international power transformer market will surpass US$35 billion by 2024, and US$166 million in South Africa alone. This is in regard to a market that is largely driven by upgrades to outdated electrical infrastructure, and the expansion and strengthening of grids.

Essentially, power transformers play the important role of ‘stepping up’ or ‘stepping down’ voltage levels in the transmission and distribution of electricity to homes and industry. They also require highly specialised skill sets to manufacture, install and commission. This becomes more critical the larger the power transformers become – especially when installed upstream in the electricity supply chain.

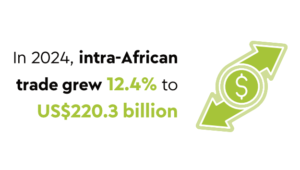

A significant percentage of the predicted new demand will likely be generated from Africa as the continent deals with its needs for rural electrification, general electrification (driven by urbanisation), existing electricity infrastructure upgrades and new projects. This will expand the demand for suppliers that have a comprehensive knowledge of all aspects of energy generation for these types of products.

This is where ContiPower holds a big advantage. The company offers a diverse range of services in the energy space, including renewable energy and cogeneration projects and solutions, transmission line and substation construction, and the supply of high-voltage electrical products and equipment, low-voltage switchboards, and motor control centres.

From a power transformer perspective, it also provides on-site services such as supervision on installation and commissioning, minor repairs, evaluations and execution of modifications, and oil treatments. From a renewable energy aspect, aside from solar, ContiPower also provides waste-to-energy and cogeneration solutions, supported by a strong team that undertakes its work with the guidance of ISO 50001 and SANS 50010.

In just three years, ContiPower has already earned a formidable reputation in the renewable energy sector, given its pipeline of 163 MW of projects that are in various stages of development. ‘Such projects, based in South Africa, Namibia, the Congo and Uganda, use technologies that include solar PV – with and without storage – mini-hydro, cogeneration and waste-to-energy,’ says ContiPower CEO Mholi Majola.

‘We also have a strong track record in supplying, installing and the commissioning of power transformers for both the private and public sectors with currently more than 110 ContiPower Class 1 power transformers in operation in South Africa alone.’

What is particularly impressive is that the company maintains a 99% reliability record for its on-time supply, installation and commissioning of the transformers – and, as Majola points out, the company ‘has not had any reported failures’.

This is the type of dedicated service excellence Africa needs as it focuses on building energy capacity. ‘Access to electricity is a priority across the continent. However, generation and transmission infrastructure is expensive and takes many years to build,’ says Majola.

‘Although there are a large number of programmes in progress or being contemplated, these will not address the immediate short-term needs.

‘The solution is for public-private partnerships [PPPs] to augment all the power programmes and projects. We’ve found that when entering into PPPs, particularly those related to renewable energy, implementation is faster. The downside is that while PPPs help to speedily close the supply/demand gap, they are often constrained [in terms of] access to foreign direct investment,’ he says.

‘A further issue is that a number of African countries have received negative credit rating downgrades, which when combined with electricity revenue collection inefficiencies, serve to reduce investor appetite.’

Last year the AfDB announced that it would invest US$12 billion in the power sector over five years under its New Deal on Energy for Africa. While off-grid may be the preferred solution, innovations such as smart/mini-grid systems that have the ability to supply electricity to small and rural communities appear to be one of the advantages for companies such as ContiPower.

Majola explains that while the company continues to focus its range of high- and medium-voltage power transformers on South Africa (where it is based) and the SADC region, it is also expanding deeper into Africa’s renewable energy sector.

‘A large number of renewable energy projects are nearing power purchase agreement and financial closure status, and we intend to make ourselves known to the engineering, procurement and construction stakeholders as solution providers – particularly those that relate to substations.’

Investment is looking healthy though in terms of the introduction of mini-grids, which Majola says require a relatively small capital outlay from the developer.

‘Mini-grids are localised electricity networks that draw energy from solar, wind, hydro and biomass. They are particularly viable in the context of getting power to remote and rural areas, as has successfully happened in Kenya and Nigeria.’

The impact on the lives of the people in these mini-grid areas is tangible, especially considering the long periods of time related to main grid access and the expense thereof. Countries investigating mini-grids include Rwanda and Tanzania, along with Kenya. Several have set a target of universal access to electricity by 2030.

The roll-out of mini-grids is being constrained by the lack of regulatory regimes and bureaucratic processes but this is not preventing ContiPower from pursuing involvement.

Part of ContiPower’s confidence comes from the announcement that it is on the cusp of achieving a long-awaited goal of being able to manufacture its own power transformers. ‘With the support of our technical partners, a number of South African development finance institutions, corporate banks and the Department of Trade and Industry, we intend to construct a facility to produce these and other key electrical infrastructure-related products locally,’ says Majola.

The facility will also be used as a training venue for staff, which is particularly important for upskilling in this highly specialised field of manufacture.

‘Some 400 new permanent direct jobs will be created, along with an estimated 100 indirect jobs. A further 200 contract employment opportunities will exist during the construction of the plant.

‘The realisation of this facility is one of our highest priorities,’ says Majola. ‘We will be able to draw on the research and development strength of our global technical partners, which we do across our basket of offerings, to ensure we apply the latest technological developments to our manufacturing and assembly processes.’

It is these partnerships that have given ContiPower a strong competitive edge when up against international suppliers. Its expansion into sub-Saharan Africa covers a broad base of sectors, including construction; civil, mechanical and electrical engineering; piping and hydrostatics; off- and onshore oil rigs; marine; transport and logistics; packaging and preservation; and petrochemical.

Customer satisfaction levels of 92% and above, determined by internal key measurements, have been achieved across aspects of ContiPower’s business, including growth, integrity, innovation and customer relationships, as well as a 100% rating for the high-quality supply of products and services.

‘Such feedback drives our sustainability, even during difficult economic conditions,’ says Majola. ‘I also believe two other key ingredients make us a popular supplier – localisation; and that we make the effort to understand a client’s marketplace and needs, as well as the legislative framework and region within which they operate.’

In aiming to be an African leader in energy, ContiPower is continuously strengthening its foothold with the products and services it offers, while advancing its strategic vision of strong participation in the energy value chain.

‘To date, our products and services include some 50% of that value chain,’ says Majola. ‘Through partnerships and acquisitions, we are confident of achieving our vision while simultaneously boosting South Africa’s local manufacturing strength with our assembly and manufacturing goals. In broad terms, we will bring benefit to our economy as outlined in our ethos, which focuses on industrialisation, infrastructure, investment, innovation, inclusion and integration.’