Prior to the 2008/09 financial crisis, there was little recognition of Africa’s economic potential. With only 3.3% of global trade, the African continent could not participate and take advantage of opportunities offered by the global economic landscape. After the crisis, home-grown companies were provided with a springboard to pursue various opportunities that existed, and similarly enabled to develop their capacity to partake in the anticipated growth in global trade and, specifically, on the continent.

That time has come – thanks to the South African government, which long ago envisioned the establishment of the Export Credit Insurance Corporation (ECIC), to support its trade expansion initiatives.

During the 40 years leading up to 2001, all the country’s export reinsurance requirements fell under the ambit of the Department of Trade and Industry (dti) and the Credit Guarantee Insurance Corporation.

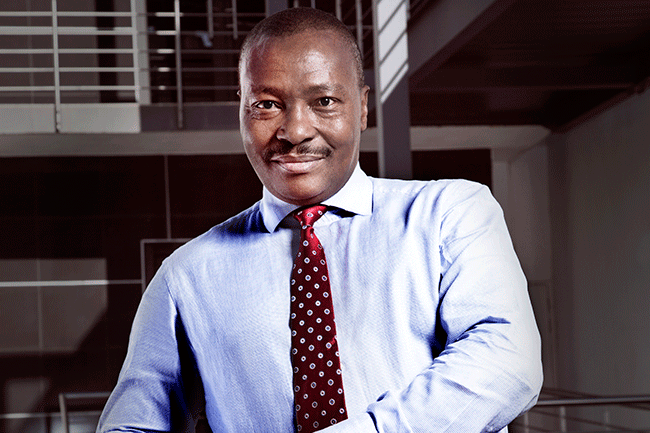

Kutoane Kutoane, CEO of the ECIC, explains that following the 1994 democratic elections, coupled with the easing of economic sanctions against the country, high export tariffs were removed, competition laws improved and South Africa began gearing itself for meaningful participation in global trade markets.

‘The participation of the private sector in the credit agency market in the years leading up to 2001 meant medium- to long-term export transactions were not being catered for adequately. The need was for a dedicated export credit agency that could provide political and commercial risk insurance cover for export credit and investment guarantees,’ he says.

‘This was done by underwriting bank loans, which are provided to South African exporters and investors.’

Enabled under the amended Export Credit and Foreign Investments Insurance Act of 1957, the ECIC of 2001 had just four employees, five board members and a balance sheet of ZAR1.1 billion, with a portfolio exposure of a little under ZAR8 billion.

‘Access to competitively priced export credit creates the ability for local contractors to bulk up and compete more effectively in foreign markets’

Fifteen years later, it now has an employee base of 82, while its balance sheet has increased eightfold to approximately ZAR9 billion, and its portfolio exposure boasts around ZAR31 billion.

Export credit insurance is unique and traditionally offered by official export credit agencies backed by their respective governments. Potential exporters need an enabling environment to successfully tender on capital projects that require significantly large financial packages. Kutoane says that with the cost of finance further impacted on by a range of factors, including sovereign ratings, exporters need a boost to remain as equally resourceful as their international counterparts.

‘Our comprehensive cover includes political and commercial risk insurance, which protects banks and other financiers against country risk and payment default,’ says Kutoane. ‘A contractor, or exporter, may also benefit from the cover for return of assets that the ECIC provides, specifically where equipment/rolling stock is supplied through a lease structure or via an instalment sale agreement, where ownership only passes on full payment.

‘Export credit for capital goods and services is customarily financed with bank debt for cash-management purposes, so it is clear that export credit financing is a crucial aspect of international trade.

‘Access to competitively priced export credit creates the ability for local contractors to bulk up and compete more effectively in foreign markets. With the ECIC in support of such transactions, exports are enabled and contractors’ capacity is fostered,’ he says.

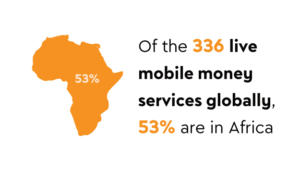

This is certainly proving true with the broader reach of the ECIC into Africa. The bulk of its portfolio – at around 90% – is in the sub-Saharan region, with 22% in Ghana, 20% in Zambia and 13% in Zimbabwe.

The sectors that benefit most from export insurance include mining, power, oil and gas, defence, aviation, transportation and other infrastructure. The ECIC has also extensively supported agriculture and energy projects in Mozambique, Sierra Leone and Ghana.

‘Our strategy is to grow our insurance footprint on the continent as “the insurer of last resort”,’ says Kutoane. ‘We see Africa as a natural base for the ECIC, with our current marketing efforts focused increasingly on the east and west sides of the continent, and particularly on mineral resources infrastructure, given that the rural environments in which mining takes place severely limits how products reach markets.

‘The ECIC is strategically positioned as a key player in facilitating the availability and affordability of long-term finance to aid in unlocking the development potential of such operations, particularly in economically frustrated regions that experience fiscal constraints,’ he says.

This is also true for the larger infrastructure rail projects, including the Nacala rail corridor between Malawi and Mozambique. The ECIC is actively involved via the provision of political and commercial risk insurance, thereby increasing the level of diverse sources of long-term finance.

Similarly, the ECIC has provided critical backing to Grindrod, encapsulating the support for rolling stock, which has enabled that organisation to supply locomotives and wagons to the Tonkolili mine in Sierra Leone and the state-owned rail company in the DRC.

Kutoane argues that infrastructure projects are a catalyst for industrial development. ‘They increase investment into domestic manufacturing and further motivate export trade,’ he says. ‘Projects of this nature also resonate with the ECIC mandate to facilitate trade between South Africa and the rest of the continent, so it is imperative that we understand regional strategies, and adopt and adapt to frameworks for a more integrated development plan across nations.’

In supporting SMEs, the ECIC’s support scheme comes into play, depending on how those SMEs measure their competitiveness globally or indirectly through sub-contracting work from larger organisations. ‘Actually, we believe that the latter might be the best way to get exposure in international projects and build experience for future opportunities,’ says Kutoane.

Within its own structures the ECIC applies a similar formula: adapting its offerings and introducing new insurance products that are in line with the South African government’s export promotion policy objectives. Last year, for instance, the ECIC launched performance bond insurance cover, and is currently exploring the covering of credit lines and return of plant and equipment. In this it works jointly with the dti to explore the feasibility of turning the ECIC into a fully fledged Exim Bank structure.

‘The ECIC is strategically positioned as a key player in facilitating the availability and affordability of long-term finance to aid in unlocking development potential’

‘Further, we continue to motivate for the release of increased lending capacity by financial institutions by entering into agreements with other export credit agencies [ECAs],’ says Kutoane.

‘This is how we create a framework for re- and co-insurance such as we do with sister BRICS ECAs, recently having adopted a comprehensive plan of action aimed at actualising co-operation programmes for mutual benefit.’

Investment opportunities throughout the continent are identified by the ECIC through its association with the Africa Investment and Integration Desk – a Nepad-structured foundation that assists financiers and investors by overcoming bottlenecks in the process of investment and development.

The ECIC also undertakes regular country-scoping visits to ensure it is on-site to identify new investment opportunities as they emerge. Kutoane says this includes nations that are emerging from years of conflict, such as South Sudan and Eritrea.

It is well known that Africans are extremely proud of their heritage and that the strategies foreign investors might apply elsewhere in the world need to be revised for the continent. The dynamics of the problems that African leaders and financiers face require comprehensive understanding – and this is where the ECIC excels.

‘We address obstacles through facilitation and by aiding in the release of funding required for infrastructure, which as we all know is of particular concern to global organisations seeking an African presence,’ says Kutoane.

‘The ECIC is also able to price African risk more effectively, given its indigenous status even though demands might be universally similar. Ideally, what we ensure is the provision of cost-competitive cover and the honouring of claims when they arise.’

Finally, he says, the ECIC is ‘dedicated to deepening regional integration, particularly across a diversification of the domestic industrial base so that nations can tap into the increasing demand of a growing middle-class consumer base’.