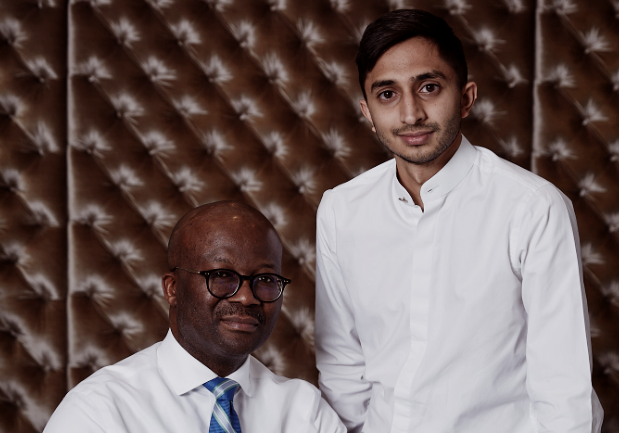

New market forces and opportunities are changing the Moti Group’s strategic approach to growth and value. Over the past 18 months it has actioned two major transitions. The first is a change in leadership, welcoming as its CEO the former director-general of National Treasury, Dondo Mogajane. The second sees Mogajane, along with executive director Mikaeel Moti, exploring new business ideas that embrace a deeper diversification approach that will steer the group into new, uncharted and high-potential investment sectors.

The diversification is based on introducing a younger perspective that will solve modern challenges using technology, particularly in the SADC region. As such, the group has been revolutionising and updating its management systems, utilising a flat structure rather than a vertical one, which introduces solutions for greater transparency and deeper internal oversight across all the sectors in which the Moti Group is already active, as well as areas yet to be explored.

New lines of business on the cards include infrastructure development, lithium power, retail and a financial services product that has a CSI flavour, adding to the group’s already comprehensive portfolio, which includes luxury goods, particularly motor vehicles, aviation, security, property, and mining and mineral beneficiation.

The mining arm of the business is being positioned to lead the Moti Group into the top 20 list of mining companies in Africa. Mogajane explains that Kilken Platinum, in partnership with Imbani Minerals, is operated at the back of the Amandelbult plant of Anglo American Platinum. ‘We’ve partnered with Anglo American for some 16 years now with a life-of-mine agreement, whereby it supplies Kilken with live tailings that we process to extract remaining PGMs, which we then sell back to Anglo American as metal concentrates,’ he says.

The Kilken plant has recently received a wave of new investment, which will significantly increase its capacity. ‘We consider PGM investment a stronger stride forward into the environmentally friendly space,’ explains Mogajane. ‘PGMs allow for the manufacture of catalytic converters that morph harmful carbon monoxide into less-harmful carbon dioxide. Within this mix are our other interests in palladium and rhodium that perform environmentally better in high-level, largescale industrial catalytic converters.’

Lithium is yet another product in which the group is investing, this time in Zimbabwe. Mogajane points out that Zimbabwe is recognised as the fifth-largest lithium producer in the world. ‘We believe it still holds a wealth of untapped opportunities and potential. The government has recently implemented new legislation prohibiting the export of raw lithium and other mineral ore, which requires all minerals to be processed within its borders. This serves us well because we already own, through our subsidiary, Pulserate Investments, 84 lithium claim sites spanning some 10 000 ha in the Mashonaland East province. The value of these sites is yet to be determined but we believe they will become one of the group’s biggest assets,’ he says.

‘We continue our drive toward establishing a lithium-beneficiation plant in accordance with Zimbabwe’s mining regulations, and will further our engagement with other like-minded companies as we seek to develop our Zimbabwean operations.’

Mining and mineral beneficiation industries are, however, cyclical, so while they may deliver years of highly profitable and bullish outlooks, the years that follow can be bearish. ‘As a result, we feel it is important to be invested across multiple sectors that are able to support regular and consistent growth and profitability,’ says Mogajane.

This is why the Moti Group has begun to expand its property portfolio, beginning with targeted investments in the Nondela Drakensberg Mountain Estate. This project includes a prestigious golf course, a racetrack and 4×4 trails, horse riding and bird-watching activities.

The luxury market has been very profitable for the group in past years, according to Moti. ‘In the long term, however, we believe it will come under increasing pressure given the challenging local and global economic circumstances. In response, our attention is directed at satisfying day-to-day needs and supplying vital resources, including the supply of such to those in need.’

This is the entry point for the African HERO project, a new financial services product for the group. Here, shipping containers, sourced from the company’s 50% share in East Rand Containers, are to be rolled out in SADC rural areas where there is little or no pre-existing infrastructure. The containers will be converted, primarily into self-sufficient clinics or schools with power-generation capabilities and water boreholes, but can also be used for voting stations, counselling centres or even as a refuge for troubled women and children, or those requiring gender-based violence support. It’s anticipated that instead of the usual 10 to 12 months that is normally required to deliver schooling and medical infrastructure, the eco-friendly container roll-out will take a mere three weeks.

According to Mogajane, ‘we will be using our own resources to convert the containers into eco-friendly, state-of-the-art facilities, as well as supporting the funding of their use, but on the basis of securing long repayment agreements with purchasing governments who, as a result, will not need to drain their fiscal resources’.

While the African HERO project is assured to cement the Moti Group’s role as a leading catalyst of upliftment through development, a further step in its new strategy embraces entrepreneurship. Moti explains that the organisation is open to meeting young entrepreneurs who can introduce concepts that meet the needs of modern society. ‘We are continuously looking for fresh blood and ideas that could offer a competitive advantage within their respective fields.’

The history of the Moti Group is steeped in entrepreneurship, and that entrepreneurial spirit is still very much alive and present within the organisation. ‘It means we are agile in our approach, with speed and urgency in decision-making, which allows us to easily capitalise on opportunities when presented, on the understanding that no business acquisition or merger is simply transactional, or a matter of rands and cents,’ says Moti.

‘Whenever we have a potential business opportunity with a third party that may need funding, advice or mentorship, we first look to the person or entrepreneur behind the concept to determine if there is a natural fit. Our business has been built on the foundation of positive relationships, both internally and externally, and we see these relationships as the true heart of our organisation.’

Such relationships include philanthropic efforts, which see the Moti Group contribute to communities with monthly donations and fund-raising efforts, and more so during times of crisis, such as in the wake of the 2021 riots and floods in KwaZulu-Natal. Moti says that the entire organisation is sensitive to the extensive needs and poverty that prevail in sub-Saharan Africa. ‘These pillars have contributed to the levels of growth and success the Moti Group has realised over the past two decades,’ he says. ‘We continue to be committed to driving foreign direct investment into the region, and in the delivery solutions that will address Africa’s most pressing service delivery and infrastructure challenges.’