As you drive south out of Nairobi on the famous Mombasa Road, you’ll pass all kinds of properties – residential, commercial… There’s even the huge retail space of Gateway Mall, just after the turn-off to Jomo Kenyatta International Airport. But while the tough economy has most of those real estate subsectors struggling to turn a profit, Kenya’s industrial complexes are seeing rising demand and much-improved business activity.

Part of that boom is a result of Kenya’s buoyant import and export trade. And some of it, of course, comes from the economic promise of the city’s Chinese-built ring roads. However, a lot of this is because of the lucrative rental yields from Nairobi’s modern warehouse properties.

‘Rapid growth in e-commerce has driven demand for warehousing that can handle large volumes of goods,’ Jiten Kerai, GM of Purple Dot International, recently told Kenya’s Business Daily. ‘With the increase in imports and exports, most are now investing in ware housing due to the growing demand of the sectors. Kenyan investors can project the need for warehousing in the next 30 years based on location, infrastructure and pricing.’

Bill Ndung’u, CEO of VSB Properties adds that ‘ultra-modern industrial complexes are ranking highly among the areas that clients and investors alike are either scouting to invest in or are looking for space to set up shop. The era of the old warehouses is quickly fading away, and even those with such units are quickly converting them to accommodate the new trend’.

Kerai and Ndung’u were probably both smiling broadly as they said that. Purple Dot International, incidentally, runs a 465 000 m² warehouse complex in Athi River, a 20 km drive down Mombasa Road from the airport.

Yet not all African property owners or investors are smiling right now. In South Africa, FNB recently published its Q1 2023 Commercial Property Broker Survey, which found that half (51%) of the commercial property brokers in the country’s six major metros are content with the current state of the market. That’s up from 47% in Q4 2022, but not by much.

When asked to rate market activity levels on a scale of one to 10, the survey respondents gave retail property 4.44 and office property just 4.08. Industrial and warehouse property, however, was given a score of 6.31 – suggesting that the subsector is better than the best of a bad bunch. If anything, ware house space is booming.

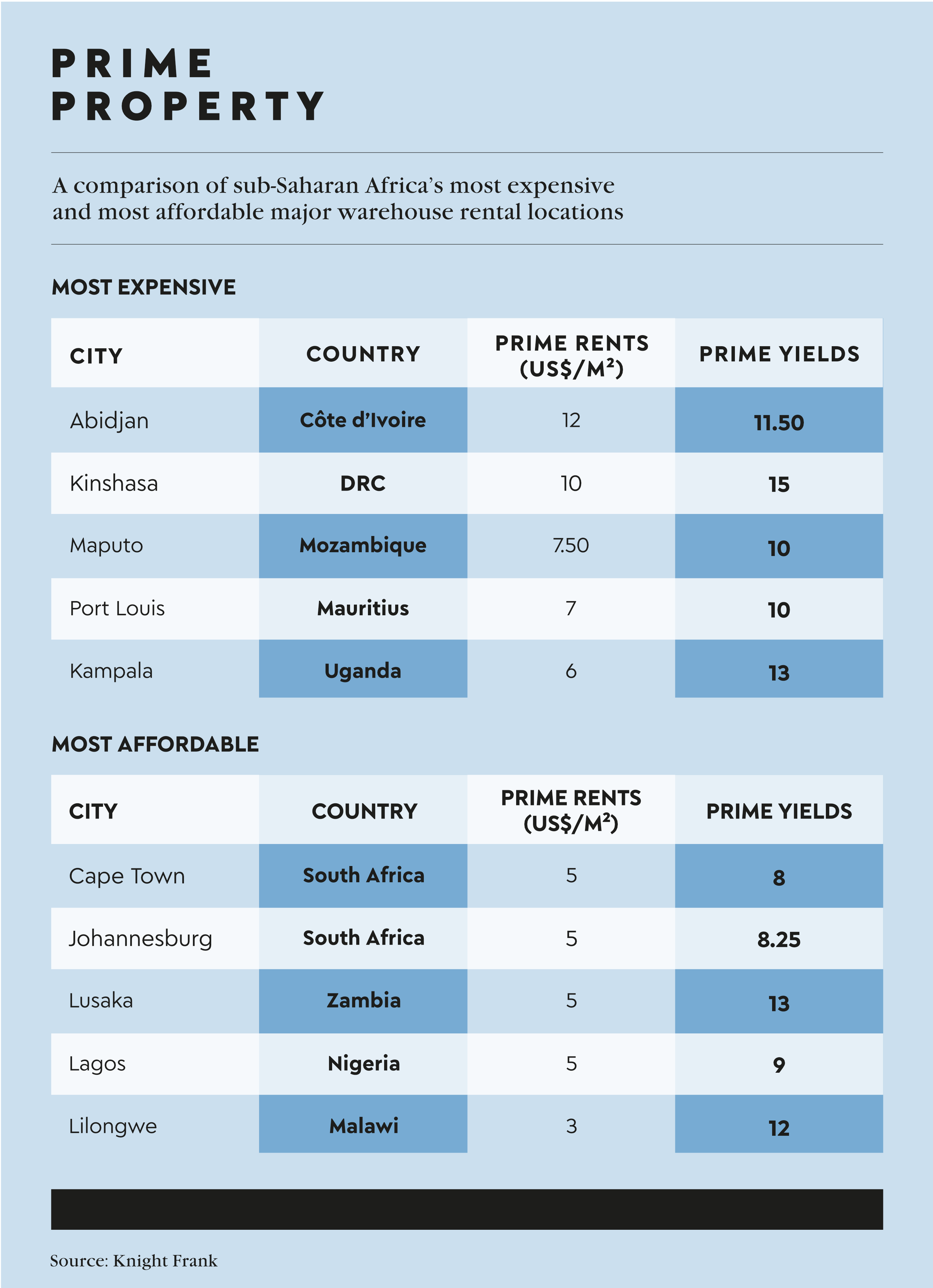

In its Q1 2023 Africa Industrial Market Dashboard report, independent real estate consultancy Knight Frank highlights a ‘persistent need’ for top-tier warehouses across Africa. ‘This demand remains unmet in most African nations, consistently surpassing the available supply,’ writes Boniface Abudho, Africa research analyst at Knight Frank. ‘An example of the long-standing inadequacy of high-quality warehousing is in Nigeria, where many multinational corporations opt to conduct their operations in self-owned, purpose-built facilities in Ikeja, Sagamu and Agbarawe. This trend highlights the strong demand for prime warehousing space, which currently amounts to 300 000 m².’

In contrast, according to Abudho, the Kenyan market has seen a more responsive approach from developers in meeting the growing demand for prime warehousing space. There, 170 000 m² of speculative warehousing has been delivered in the past five years alone.

‘Before this, the prime market was limited to just a few developments,’ he writes. ‘Further improvement in warehousing supply is expected to occur with the plans of developers such as Improvon and Africa Logistics Properties to deliver more than 400 000 m² of speculative space to the market by the end of 2024.’ And while most warehouses are constructed speculatively, Knight Frank’s research shows high absorption rates, largely fuelled by the agriculture and fast-moving consumer goods sector. ‘Unsurprisingly, the average occupancy rate is presently at 80%.’

As Kerai notes, the growth in African e-commerce is driving demand for ware house and distribution space. This is especially evident in South Africa, where those properties have outperformed all others. Knight Frank reported an overall income return of approximately 9.2% and capital growth of 0.8% for warehouse and distribution properties in 2022.

‘A good example of the focus on prime warehousing space has been Takealot’s recent leasing of approximately 11 000 m² of space in Montague Park in Montague Gardens, Cape Town,’ says Raul Flores, director of South Africa’s Titan Property Group. ‘The buoyancy of demand is clearly reflected in the active development pipeline, but also in the performance of rents. In comparison to pre-pandemic rates, the highest increase in average prime rents is across Africa.’

As the Purple Dot International example suggests, many of Africa’s key warehouse hubs are springing up around the continent’s busiest airports. In January 2023 Ethiopian Airlines announced it is building its own dedicated, 15 000 m² e-commerce ware house, with a 150 000-ton annual capacity. The facility, located adjacent to the cargo terminal at Addis Ababa’s Bole International Airport, is being built in partnership with e-tail giants Alibaba and Amazon at a cost of US$50 million. Abel Alemu, Ethiopian Airlines Group’s MD of cargo and logistics services, recently confirmed that the warehouse would be fully automated, with an automated sortation system and electronic transport vehicles processing shipments ranging from small parcels to boxes, skids and built-up units.

Yet it’s not just large properties or global e-tailers that are driving Africa’s warehousing boom. In South Africa, JSE-listed real estate investment trust Stor-Age has noted a trend of SMEs using self-storage – rather than ware housing – to store stock, manage e-commerce fulfilment, or operate as a distribution hub. Stor-Age puts this down to the convenient suburban locations of their facilities, combined with the security and flexibility that self-storage offers. They even have a name for it – micro-warehousing.

‘These micro-warehousing units are acting as business hubs for SMEs across the country,’ according to Chris Oosthuizen, Stor-Age chief marketing officer. ‘We have many businesses, especially those in the e-commerce space, who are taking advantage of month-to-month rentals in enhanced units that are able to complement their existing operations. For many, it’s a no-brainer as they have an incredibly low risk means of either starting or growing a business.’

And as e-commerce continues to grow, all players – from local small businesses to famous global giants – will need space to store their goods, and bases from which to operate and distribute their wares. Ware houses are perfectly positioned to provide that solution.