In London, vacant office space is up 50% from 2019. Vacancy rates across the US were at a record 19.1% in late 2022, and in New York City, the average office occupancy rate is down about 53% compared to before COVID, according to US workplace security firm Kastle Systems.

Premium office vacancies in Hong Kong have almost tripled in the past three years to an all-time high and, in Sydney, office occupancy is predicted to fall by 20% by 2026.

Delta Property Fund’s integrated annual report 2022 states that in South Africa, office vacancies over the past three years increased from 11% to 16.7%. Comparing South African Property Owners Association data from Q1 2019 and Q1 2022, it says that B- and C-grade office vacancies increased from 13.1% to 19.9% and 14.9% to 16.4% respectively, while A-grade and P-grade office space increased from 9.2% to 13.4% and 8% to 14.4% respectively.

This appears, of course, to be the result of a pandemic-propelled handbrake turn into the ongoing experiment that is remote work, not to mention job losses and higher interest rates. However, the WFH trend was already in place, albeit on a gentler curve.

‘There was an oversupply of office space in Gauteng prior to 2020, so the pandemic, and the work-from-home policies in particular, magnified existing issues,’ says Derrick Pautz, head of developments for commercial real estate company Atterbury Properties. Regardless, the corporate world – employers and employees alike – is still coming to terms with its WFH ambivalence, while the commercial real estate sector, too, is having to chart a new course in order to survive the resultant loss in lease revenues and investment.

Office-to-housing conversions may offer some relief. While office space was particularly hard hit during lockdown, WFH has created a new demand for residential property that caters to changing lifestyle and remote work needs.

This is well under way in the US and UK, with some US states considering introducing (or already having introduced) financial incentives to convert downtown office buildings into housing.

South Africa’s property sector is certainly taking up the challenge. International company Growthpoint Properties will apply its cross-sector development expertise to the ZAR200 million residential conversion of its Riverwoods office park in St Andrews, Bedfordview, in a joint venture with the Setso Property Fund (which specialises in office-to-residential conversions). The studio, one- and two-bedroom apartments are designed to attract an upcoming generation of first-time buyers. ‘As part of our ongoing asset management, we frequently evaluate the properties in our portfolio and consider all options to unlock the best value from our assets. There is no recipe, no single solution, so we take care to find the right approach unique to every building,’ says Paul Kollenberg, Growthpoint head of asset management.

Atterbury Properties has also had success with office-to-real estate conversions. However, cautions Pautz, the scope for conversion is fairly limited. ‘Our conversions of Absa Towers Main and Jewel City [an extension of the Maboneng Precinct] in the Johannesburg CBD were very successful. But most of the factors were optimal in those conversions.’

Not all office buildings are eligible for conversion. ‘Residential conversions are only feasible in a minority of buildings. The depth of floor plate, the facade materials, the services, parking, and so on, must all be taken into account; never mind the residual value of the building prior to conversion.’

While the market for larger, more traditional office blocks may be stagnant, more modern, specialised offices are proving lucrative. ‘We’re seeing a lot of activity in the smaller, bespoke office sector, so having the right product for that market can be lucrative,’ says Pautz.

‘Atterbury’s Castle Gate Office and Gym development in Pretoria was fully let and developed during the height of the pandemic.’ Atterbury was fortunate in that it didn’t have big commercial land holdings or developments ongoing prior to COVID. The one major commercial development planned before 2020, Barlow Park, was originally envisioned as an office-focused project, but has now been completely reimagined as a residential-led mixed-use precinct, currently under construction.

‘The success of the first phase of the Barlow Park precinct is testimony to the demand for well-located, amenity-rich, affordable housing. The first phase consists of 750 residential units, and a convenience retail centre and a Curro high school. The full development, over five phases, will consist of 4 100 residential units, the convenience centre, the high school and future primary and pre-primary schools. There is also scope for medical and commercial uses integrated into the master plan.’

Another avenue being explored (speculatively) by commercial property developers is office-to-warehouse conversions. The online shopping boom has seen a global increase in demand for warehouse and distribution spaces, and South Africa is no exception, with its newly available delivery channels from big retail brands. ‘A positive for the industrial market is the ever-growing demand for new-generation warehouse or distribution space,’ states Rode’s Report on the South African Property Market.

This type of conversion poses numerous challenges, though, as most office buildings may not be suitable for distribution or warehouse conversion. Until such time as these challenges can be overcome, we’re unlikely to see this sort of conversion in South Africa. Currently, it seems the most viable conversion may be simply to upgrade current, more traditional office space to align with evolving workplace needs, as well as the trend towards greener buildings.

If the US is any indication, the vast majority of employees will probably be heading back to work under a hybrid model. The 2022 BOMA International COVID-19 Real Estate Impact study found that 86% of office tenants in the US believe office space is or will be vital to conducting a successful business, and 70% were either likely to, or unsure whether to re-assess their space needs. Of the 70%, 61% of respondents said they were likely to reduce their square footage. Two-thirds of employers would prefer hybrid work set-ups with at least three to four days in the office – a percentage that aligns exactly with the preferences of the employees they manage.

This points to an (eventual) increase in demand for smaller work spaces that cater to hybrid workers’ requirements, including greater technological/digital integration, and smaller, more flexible (pods, hot desks and so on) and communal workspaces.

Add to this the fact that C40 cities (Johannesburg, Cape Town, Ekurhuleni, Ethekwini and Tshwane) have pledged to have all new buildings operating at net zero carbon by 2030 and all buildings (new and existing) operating at net zero carbon by 2050, and the pressure is on for any conversions to tick the correct green boxes.

‘There is a strong focus on ESG and net zero, so the buildings that are being designed and constructed are more likely to have a sustainability focus. There might not be as many buildings being built, but those that are, are built with sustainability aspects and possibly net zero goal,’ say Marloes Reinink, director of Solid Green Consulting.

According to Property Wheel, investment performance for certified green prime and A-grade offices improved in 2021, outperforming non-certified assets of a similar quality by 170 basis points during the year.

The demand for green office spaces is a big incentive for property companies, she adds. ‘Energy efficiency building regulations (SANS 10400 XA) [were] updated in 2021 and there are more stringent requirements in terms of the legislation. So where in 2011 a new office building in Johannesburg had to demonstrate that the predicted consumption was below 200 kWh/m2/annum, in 2021 they must demonstrate consumption below 90 kWh/m2/annum. The energy trajectory is to achieve an 8% reduction on previous maximum annual consumption every two years.’

Based on current economic conditions, the future of the commercial property sector is murky, to say the least – although there are some tentative rays of hope.

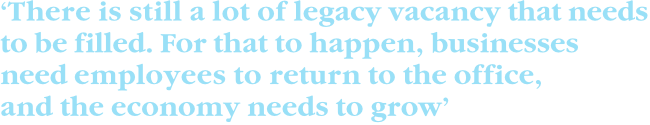

‘There is still a lot of legacy vacancy that needs to be filled,’ says Pautz. ‘For that to happen, businesses need employees to return to the office, and the economy needs to grow at a meaningful rate. Prime office nodes need to protect their status and ensure their value propositions of the past – access, amenities, safety, cleanliness, cost and so on – are upheld.’