If ever proof were needed of the importance of properly functioning ports in Africa, the stranding of the 200 000 ton Ever Given container ship in the Suez Canal in March 2021 is it. Blocking 400 ships on either side of the canal, it brought trade to a screech-ing halt. Jamming about US$9.6 billion worth of trade a day, the incident highlighted the vulnerability of global trade when reliant on a single major chokepoint. The indispensa-bility of the ports along Africa’s 30 500 km coastline, as an alternative global shipping route, came into sharp relief. In addition, by some estimates, more than 90% of Africa’s own imports and exports are conducted by sea.

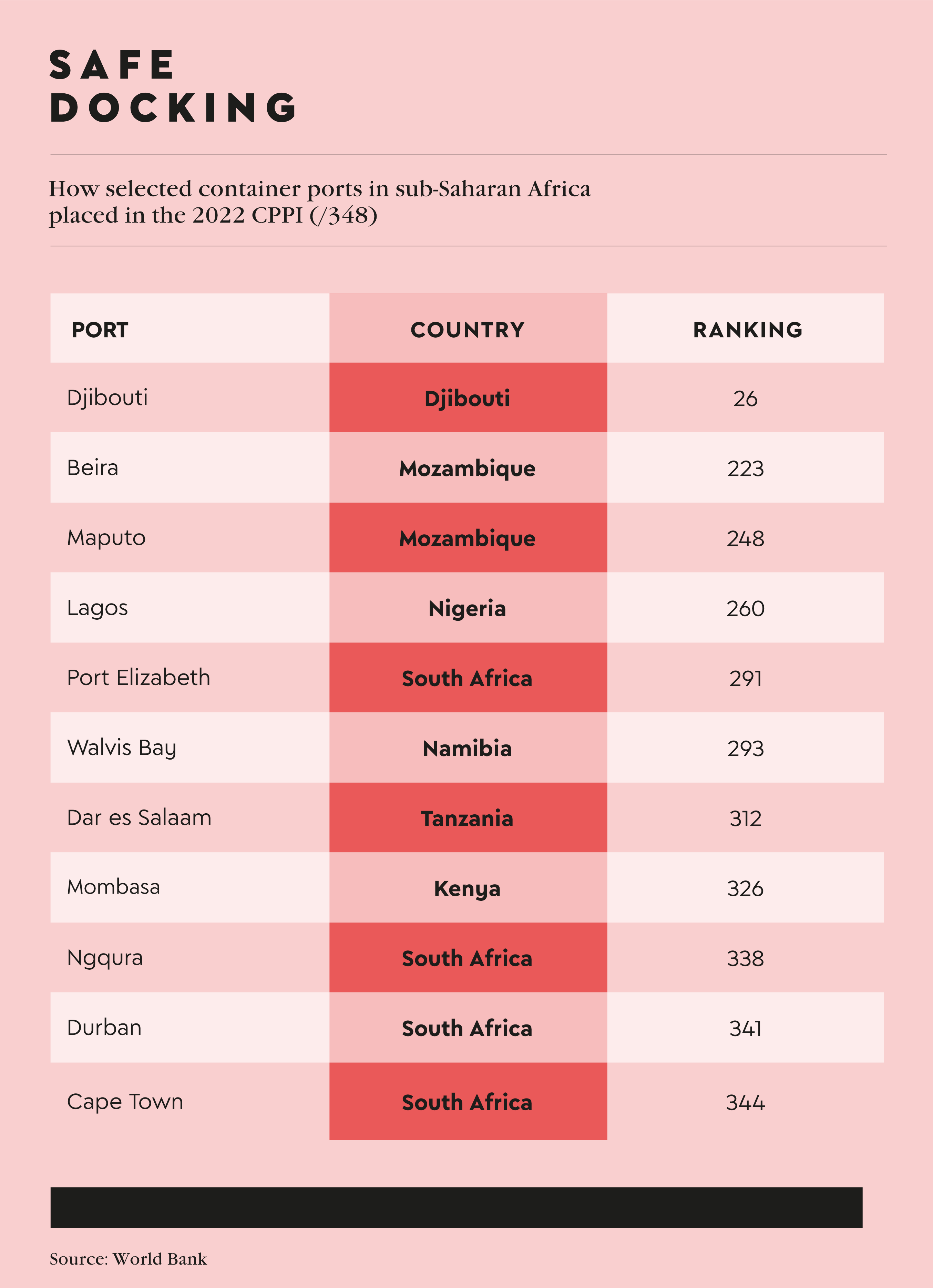

One of the first ports of call after the Suez is Djibouti, whose Vision 2025 includes a multibillion-dollar investment plan for its ports and infrastructure. Although the country is small, Djibouti has big ambitions – its goal is to become the Singapore of Africa. It is strategically located on the Horn of Africa at the entrance to the Red Sea, making it an important maritime hub connecting Africa, Asia and Europe. Its 370 km coastline, wrapped protectively around the Gulf of Tadjourah, is home to four ports – Djibouti, Doraleh, Ghoubet and Tadjourah. Djibouti has been ranked as the top container port in sub-Saharan Africa (and in the global top 50) by the World Bank’s 2022 Container Port Performance Index (CPPI).

Aboubaker Omar Hadi, chairman of the Djibouti Ports and Free Zones Authority, says the ranking ‘is evidence of our world-class facilities and services that have allowed our country to become an ultramodern regional and global trade and logistics hub’.

The importance of the port of Djibouti as a regional shipping route has been recognised for more than three centuries, serving among others the Phoenicians, Egyptians and Romans, before French colonists built a port here in the late 19th century. Currently, the port has two container berths that can handle 8 000 TEU (twenty-foot equivalent units) container ships, and there are plans to add another berth with stern ramps to accommodate RORO (roll-on roll-off) vessels. Also in the pipeline are a liquid natural gas (LNG) terminal, a business zone, ship-repair yards, a crude oil terminal, an international airport and railway lines connecting Tadjourah, Mekele and, crucially, Addis Ababa, capital of landlocked Ethiopia. About 90% of Ethiopia’s trade already passes through the port, and Djibouti is poised to benefit further from a World Bank-funded project to upgrade the Addis-Djibouti Corridor.

China, as part of its Belt and Road Initiative, has been involved in developing the port of Doraleh for a number of years. Funded by the Chinese Merchants Group, the US$590 million Doraleh multipurpose port was inaugurated in 2017 and has capacity to handle 8.2 million tons of cargo and more than 200 000 TEU. There are also plans to build another 11 wharves at Doraleh. Across the Gulf from Doraleh and Djibouti, about US$90 million has been spent on developing the multipurpose port of Tadjourah, which handles general cargo and potash exports.

Further south along Africa’s coastline, at the port of Mombasa, Kenya last year commissioned a new oil terminal – the KES40 billion Kipevu Oil Terminal 2 (KOT2) – and a second container terminal, which cost KES62 billion over two phases. Both projects have significantly improved capacity at the port, which has long been bedevilled by congestion. KOT2 accommodates four vessels with a deadweight tonnage (DWT) of up to 170 000, while the old terminal could handle only one 110 000 DWT vessel. The new container terminal has boosted the port’s container capacity to more than 2.08 million TEU a year.

Business Insider Africa, however, reports that Mombasa’s cargo-handling volume decreased for the first time in five years last year, with many attributing this to rivalry from Dar es Salaam, which is becoming the favoured route for the landlocked countries in the Great Lakes region – Uganda, Burundi and Rwanda.

In response, the Kenya Development Corporation this year announced it is looking for a partner to lease and manage five other ports – Kilindini harbour, Lamu port, Dongo Kundu port, Kisumu port and Shimoni Fisheries port – as part of a US$10 billion public-private partnership (PPP) initiative.

Tanzania for its part is also reportedly looking for a global investor to manage operations at Dar es Salaam.

In South Africa, the Transnet National Port Authority (TNPA), which oversees South Africa’s eight commercial seaports, unveiled its Port Development Framework plans in July this year, outlining its strategy to deliver an efficient smart-port system, which offers extra capacity and is sustainable. The plan, which envisages spending ZAR13 billion over the next five years, entails optimising ports to ensure they are fit for purpose.

At the port of Richards Bay on the east coast, for example, the South Dunes liquid bulk terminal will be expanded to handle liquid and gas commodities. The TNPA says its plans for Richards Bay are aligned with the Department of Mineral Resources and Energy’s strategic plan for gas-to-power, while its Durban neighbour, one of the busiest and biggest ports in Africa, is enhancing its container capacity.

Two weeks after unveiling the development framework, the TNPA announced it had entered into a PPP with Philippines-based International Container Terminal Services (ICTSI) to operate and expand Durban’s Container Terminal Pier 2, which already handles close to half of South Africa’s total port traffic.

‘Private sector participation in Pier 2 is a key catalyst for repositioning the port of Durban as a container hub port,’ according to Transnet.

Transnet and ICTSI will share ownership of a new company (Transnet will own 51%), which will manage the terminal for 25 years and seek to increase annual throughput from 2 million TEU to 2.8 million units. TNPA’s ultimate goal is to boost Durban’s total container capacity to 11.4 million TEU from 3.3 million.

These developments are part of a much more ambitious vision for the two ports. The KwaZulu-Natal Logistics Hub (KZNLH) development programme, approved by the TNPA in 2022, is based on the two ports’ masterplans, which include 33 flagship projects with an ultimate estimated investment of more than ZAR100 billion.

The programme, according to KZNLH’s portfolio director Bridgette Gasa-Toboti, ‘is a game-changer for the province, the country and the continent’.

Further south along South Africa’s coast, the TNPA will promote the port of Port Elizabeth as an automotive hub while relocating manganese and liquid bulk facilities about 20 km away to the port of Ngqura. In East London, meanwhile, the N-berth quay will be deepened, also to support the local automotive sector.

At Mossel Bay, the TNPA plans to acquire strategic land parcels to expand the port, while it will enlarge the Culemborg logistics park at Cape Town to include more warehousing, cold storage as well as facilities for stuffing and destuffing of containers. It will also seek to provide LNG facilities at the port of Saldanha Bay, aligned with the gas-to-power plan in the region.

Looking further into the future, Boegoebaai on the west coast, about 20 km south of the Namibian border, is central to the Northern Cape’s green hydrogen aspirations. This will require the greenfields development of a deepwater port. It is envisaged that the new port will feature a dry bulk terminal for exports; a liquid bulk terminal to handle various bulk liquid products and a multi-purpose container terminal. Driven by the Northern Cape Economic Development Trade and Investment Promotion Agency, it is the first development of this size in almost three decades in the province with a total estimated investment value of ZAR100 billion.

Across the border, Walvis Bay is part of a plan for Namibia to develop and export green hydrogen. The Namibian Port Authority (Namport) has reportedly set aside 350 ha at Walvis Bay’s north port for green hydrogen-related industries. It’s also involved in a pilot project to convert existing tugboats into dual-fuel vessels capable of running on green hydrogen, a project that could potentially be extended to other cargo-handling equipment that use diesel.

Walvis Bay is also central to Namibia’s vision of becoming a key gateway to markets in Southern and West Africa. In addition to the multibillion-dollar National Oil Storage facility completed at Walvis Bay in 2021, a new container terminal, built on 40 ha of reclaimed land, was fully commissioned in 2020.

According to the AfDB, which partially financed the US$300 million container terminal, ‘the project fully achieved its goals, increasing the terminal’s capacity from 355 000 TEU to 750 000 TEU a year. It has also reduced vessel waiting time to less than 8 hours and cut container transit time from 14.5 days to 9.5 days’.

Africa Logistics reported last year that Namport, as with many of the port operators in Africa, is going the PPP route, having selected Terminal Investment Limited as the preferred bidder to run the new container terminal to fully leverage the extra capacity.

The DRC, too, has gone the PPP route, with its Matadi Gateway terminal being jointly run by ICTSI and La Société De Gestion Immobilière Lengo. Matadi – which is sub-Saharan Africa’s fifth-best-performing port, ranked at 197 in the CPPI – is being expanded even further, with ICTSI investing US$100 million in a second-phase expansion at the port.

Further north, in Senegal, Dubai-based logistics company DP World, in partnership with the government, is developing the Ndayane Yenne port, about 50 km from Dakar. The US$1.13 billion development will be built over two phases, with the first to include a container terminal offering 840m of quays and a 5 km marine channel. The second phase includes the development of an additional 410m container quay.

African ports are clearly positioning themselves as key players in global trade, which – in the long term – will only grow the region’s economic prosperity.