If you were born in South Africa after 1980, you would have grown up with television – if not directly, then certainly with the idea of it. It might seem unfathomable that television was introduced in the country less than 50 years ago. It was viewed by the then Nationalist government – in the words of Albert Hertzog, the Minister of Posts and Telegraphs – as ‘the devil’s own box, for dissemination of immorality and communism’.

One of the first South African-made television programmes to air on SABC, the sole broadcaster at the time, was the Dingleys, an English-speaking drama about a very white middle-class family set in Pietermaritzburg, in KwaZulu-Natal.

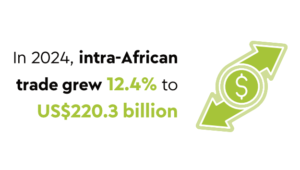

Looking at the entertainment and marketing sector in 2024, Hertzog’s head would explode if he were still alive. For one, the ‘devil’s own box’ has largely been replaced in Africa by a powerful handheld device on which users can view content from almost anywhere in the world, at any time, and in almost any language – Korean, Japanese, Mandarin, Xhosa… Yoruba.

The Nigerian-made thriller the Black Book, released on Netflix in September 2023, is one of the global streaming giant’s most successful African films to date, reaching third place in its top 10 list globally. While it is an English-language film, a large number of the cast is Yoruba-speaking, including its leading man, Richard Mofe-Damijo.

According to the Hollywood Reporter, the film was watched by more than 20 million people in its first few weeks after release. First-time director Editi Effiong believes one of the reasons for the film’s success is its authenticity. ‘It was important for us to see Lagos through the eyes of everyone in the city; through the eyes of poor people, middle-class people and rich people. To show the world in a way that Nigerians can see themselves reflected in it,’ he told Hollywood Reporter.

Effiong made the movie for US$1 million, or 1% of the cost of a John Wick movie – the Hollywood franchise to which the Black Book is most often compared.

The attraction for Netflix is clear. Between 2016 and 2022, it has invested US$23.6 million in Nigeria to license 283 titles and commission three original shows.

Speaking at the Durban FilmMart in July 2024, Dorothy Ghettuba, Netflix director of content for Africa, explained that the company’s strategy was to tell ‘authentic stories that will resonate with local audiences first’ before becoming global breakouts. She references the Korean-made international sensation Squid Game as good local content with global appeal.

The absence of local content might one of the reasons behind failure of a string of African video streaming platforms, such as telecoms giant Vodacom’s Video Play, which shut up shop in 2022. It was not alone; other telecoms to try streaming and fail include Telkom’s Telkom One, MTN’s VU and Cell C Black.

According to Léa Zouein, an analyst at Paris-based market intelligence firm Dataxis, ‘acquiring content is expensive’. Not only is it expensive, licensed content also battles to compete with the likes of Netflix and Amazon, which have access to a global audience. In addition many big studios, such as Disney, which has its own platform, no longer license to third parties, reducing the available content pool.

‘Producing content requires mobilising significant resources, whether financial or technical,’ Zouein told online tech magazine Rest of the World. ‘This is why success can take longer to arrive and be limited, compared to services with existing activities.’

Vodacom learnt that lesson, saying at the time of Video Play’s demise that it was sticking to what it knew best, by becoming ‘an enabler for consumers to access the growing demand for video and content streaming’.

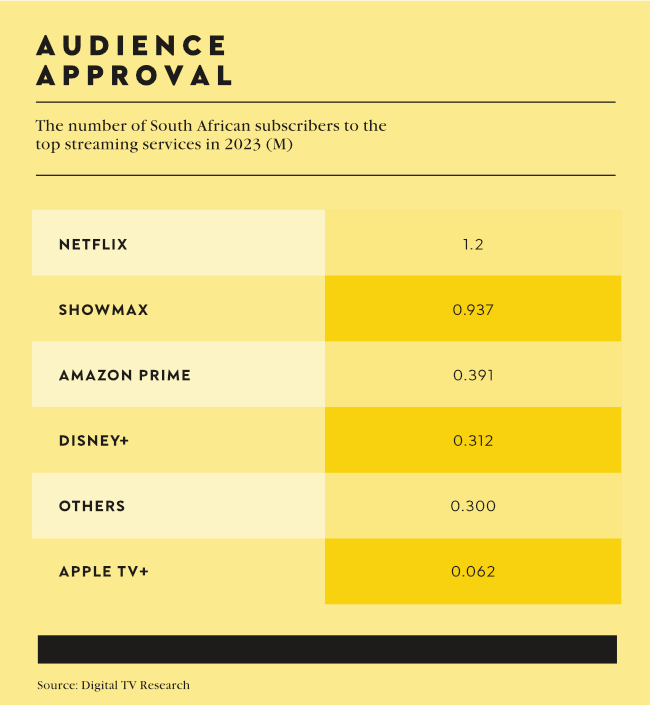

However, one African platform is managing to keep up with the big guns, if not to out-gun them. Showmax, according to global tech research company Omdia, has become the most popular streaming platform in Africa. At the end of last year, Showmax had 2.1 million subscribers on the continent, compared to 1.8 million for Netflix, although the positions are reversed in the South African market.

‘The SVOD [streaming video-on-demand] sector in anglophone Africa is evolving into a battle between Netflix and local player Showmax. Rich in local content and sports rights, Showmax now has access to NBCUniversal, Sony Pictures and HBO content,’ says Simon Murray, principal analyst at Digital TV Research.

While parent company MultiChoice has been haemorrhaging customers as viewers move to more affordable SVOD platforms, it is pumping money into Showmax. MultiChoice, which sold a 30% share of Showmax to NBCUniversal (NBCU) in April 2023, said it had committed to paying NBCU’s streaming platform Peacock, which now hosts Showmax, almost ZAR7 billion over seven years for supplying its content streaming software and services to Showmax.

According to MyBroadband, MultiChoice and NBCU have together invested a total of ZAR5 billion in Showmax. MultiChoice is leveraging local content acquisition and production, combined with a selection of premium international content and popular sports, in its bid to cement Showmax’s position as Africa’s leading streaming platform.

According to MyBroadband, MultiChoice’s other advantage in Africa over other services is that it can offer a range of payment options familiar to African users other than standard card payments.

Showmax can also draw MultiChoice’s massive local content pool, about 6 500 hours of content made in 22 languages per year, Showmax CEO Marc Jury said in an interview with Rest of the World in October 2023. ‘We’ve produced more than 30 Showmax Originals across South Africa, Nigeria, Kenya and Ghana so far. This is only going to increase in the coming months. In December, we’re on track to launch 15 Showmax originals and five films.’

Meanwhile, Amazon Prime, which made a stab at producing local content for Africa, announced at the beginning of the year it was downsizing operations in Africa and the Middle East as part of a restructuring programme, disappointing local producers, who said Amazon was ignoring a potentially lucrative market. ‘This move does, unfortunately, reinforce the idea that Africa and its creators are seen by international streamers as low-cost labour, pretty locations and performative “giving back” politics as opposed to a legitimate audience and marketplace,’ one producer told News24.

To rub salt in the wound, the Amazon-produced Fragile King won five trophies, including for best feature film, at the South African Film and Television Awards in October.

Netflix though doesn’t seem to be going anywhere. Of the US$175 million it has invested in Africa since 2016, about US$125 million is in South African-made content, licensing 173 titles and commissioning 16 original shows. ‘We are so committed to Africa. We are committed. We are here to stay,’ Ghettuba told the Durban FilmMart.

While 5G penetration is still low in on the continent – 3.1% in South Africa, for example, compared to the global average of about 19%, it is expected to improve with the roll-out of more sophisticated internet infrastructure, according to PwC’s Africa Media Outlook report for 2023 to 2027. That means consumers will increasingly be able to access data-heavy services and platforms, on-the-go.

‘There is significant room for growth within the African over-the-top [OTT] market, with South Africa posting the highest OTT revenue on the continent,’ the report notes, referring to video or audio content that is accessed/streamed over the internet.

It adds that the fierce competition between global streaming platforms is expected to stimulate growth in South Africa’s OTT market, which generated ZAR7.2 billion in revenue in 2022. It further notes that a challenge for OTT services will be to ensure content is easily streamed on mobile devices.

The 21st century’s devil’s own box? No. A passport to a world of imagination and creativity? Definitely.

By Robyn Leary

Images: Freepik