Adulting is hard. At least, that’s what the Instagram memes used to say. But as millennials have grown older (and grown up), they’ve started adulting more and more – and the insurance industry, the most ‘adulty’ of financial services, is maturing as a result.

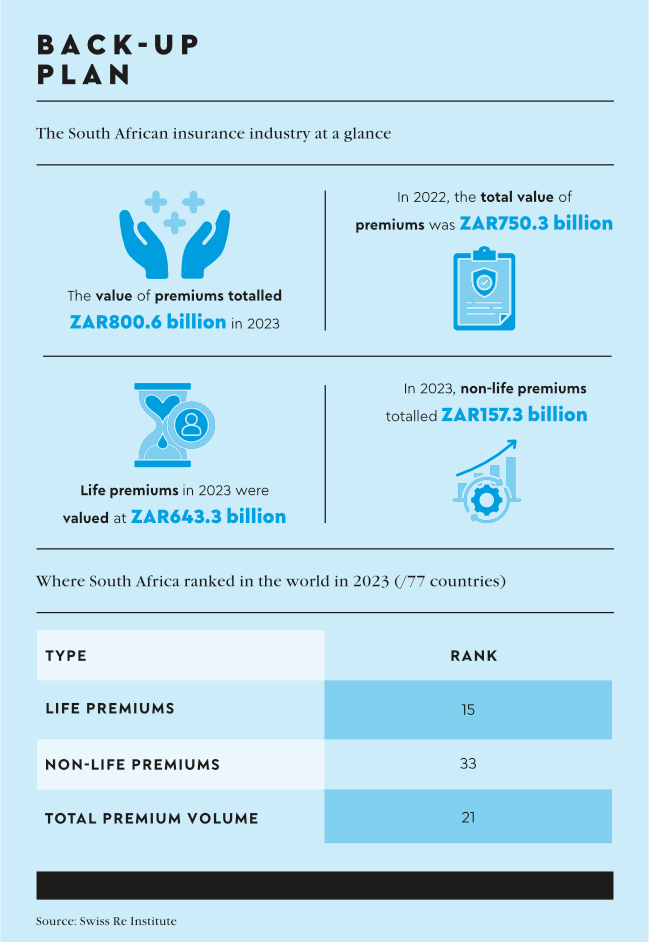

According to market research firm IMARC Group, the African insurance industry, having reached US$87.4 billion in 2023, is expected to grow by 6.3% between 2024 and 2032.

‘The millennials have a big role to play in Africa’s insurance growth, as they begin to build families and acquire property,’ according to Mulenga Kashiwa, technical underwriting senior manager at Hollard International. Millennials – that is, people born between roughly 1982 and 1994 – are now in their 30s to early 40s, a phase often associated with significant life changes and accompanying shifts in priorities. ‘Unlike previous generations, the millennials have a greater appreciation of the role of insurance in securing their financial future and protecting their assets,’ says Kashiwa. ‘However, the trend has been that they are demanding more from insurers – including flexibility in product design and premiums aligned with their specific financial needs.’

That’s causing a shake-up in the African insurance space, with nimble insurtechs emerging to offer digitally driven solutions for that younger, tech-native generation.

Hollard, for example, made a strategic investment in South African insurtech Simply in 2023, following seed investments in other insurtechs Naked and Dotsure. Simply uses proprietary tech as well as intuitive design to deliver retail and group life policies – primarily for mass-market clients. ‘The current model for long-term insurance in the mass market is unsustainable,’ says Simply co-founder Anthony Miller. ‘There’s an oversupply of expensive, standalone retail products, especially funeral cover, with high policyholder churn and, ultimately, low value for money for customers.’ Simply disrupts the space by offering combinations of benefits and getting employers to pay the premiums where possible.

Elsewhere, digital insurer Pineapple recently concluded a ZAR400 million funding round, while rival Root announced last September that it had raised US$1.5 million for a global expansion. And while that was happening, insurance giant Old Mutual sealed a strategic partnership with no-code insurance software-as-a-service platform CoverGo, through an investment in CoverGo’s US$15 million Series A round in 2022.

The deal allows Old Mutual to streamline its very well-established insurance ecosystem by launching insurance products quickly, increasing sales through new channels, and improving user experience across its 13 African markets.

‘Insurance companies in emerging markets are looking to accelerate their digital transformation and drive efficiencies across the whole insurance value chain without heavy IT development,’ says CoverGo CEO Tomas Holub. ‘As a result, we have seen a fast-growing demand for CoverGo as a truly configurable no-code platform.’

Digital technologies are also driving growth from the retail consumer side. Mishaya Chettiar, executive head of insurance comparison platform Everything.Insure, explained why in a recent interview with Connecting Africa. ‘We found that insurance is an area that consumers really don’t understand,’ she said. ‘A lot of us have insurance, but we don’t really understand what we’re buying and it’s a grudge purchase. You buy it because you need it, but you feel like you’re taken advantage of, and part of that reason is because you don’t understand it.’

Insurance, she said, is shifting online in the much same way the banking sector did a few years ago – and for much the same reason. Going digital makes it easier and more accessible to end-users in the retail space.

‘Insurance is something that is sold, not bought, typically,’ Chettiar told Connecting Africa. ‘Prior to tech somebody had to come out and offer you insurance. Tech is enabling insurance to go out into all the corners of South Africa and Africa and make it more accessible. Anybody with a smartphone can now buy insurance a bit easier.’

And it’s about time, too. ‘The insurance industry is seen as a laggard in technology when compared to other vertices like banking,’ said Riaan Singh, PwC South Africa digital transformation solutions lead, at the launch of PwC’s 2023 South African Insurance Sentiment Index.

He spoke of a ‘pressing need’ for insurers to shift from ‘digital’ capabilities to being truly tech-enabled. ‘Integrating emerging technologies and advanced analytics can provide robust data insights for a more targeted understanding of how to meet customer needs and increase overall sentiment,’ he added. ‘Fully utilising AI-enabled tech can circumvent manual processes to effectively and efficiently service and communicate with customers, allowing staff to focus on value-adding engagements.’

Jerry Anthonyrajah, executive for strategy, investments and brand at Old Mutual Insure, agrees. He sees AI enabling traditional insurers to reduce costs, enhance compliance and increase customer experiences by giving them choices as to how they engage with their insurer. However, he does not see insurtech disruptors replacing traditional insurers. ‘Insurtechs that have attempted to take over the entire insurance value chain are struggling, with the likes of Lemonade punished by the market,’ he says. (US-based Lemonade uses AI and chatbots to process claims.)

‘We are more likely to see traditional insurers and insurtechs form potent partnerships that draw on the strengths and skills that each brings to the table,’ says Anthonyrajah. ‘Traditional insurers stand to benefit from the technology and innovation insurtechs have used to solve problems. Meanwhile, insurtechs benefit from traditional insurers’ extensive distribution, underwriting expertise, and compliance resources.’

Meanwhile, CG Selva Ganesh, South Africa CEO at In2IT Technologies, sees the boundaries between banks, telcos and insurers becoming increasingly blurred as all three fields continue to embrace digital technology for their respective purposes.

‘As customers increasingly embrace digital payment transactions and online banking, the financial industry must adapt to meet their evolving needs,’ he says. ‘Additionally, affordable telco connectivity services and technological advancements in connectivity speed are creating an environment ripe for collaboration.’

Ganesh adds that mobile penetration plays a crucial role in this convergence – especially particularly in rural areas. ‘It allows banks and insurance companies to expand their customer base and provide services to previously underserved populations,’ he says. ‘As these driving forces continue to gain momentum, the lines between these industries will continue to blur.’

And as those lines blur, traditional insurers will also work more closely with digitally driven fintech upstarts and start-ups – potentially driving further growth in the industry. Because while millennials are insuring themselves more and more, there remains a significant gap in the industry. In its 2022 Gap Study, the Association for Savings and Investment South Africa found that people aged between 30 and 39 are often underinsured by approximately ZAR1.4 million. The insurance industry still has some growing (up) to do.