Data is king. Its power to transform industries, empower businesses and connect people is unparalleled. On the African continent, as elsewhere in the world, the demand for data is surging, driven by the digitalisation of services, the connectivity afforded by more submarine cable infrastructure and the growth of cloud computing.

In particular, the convenience, scalability and cost-effectiveness of the cloud has become irresistible to companies seeking to remain competitive in an ever-evolving digital world, hence the fact that so many African businesses are turning to the cloud for their data storage and processing needs.

Yet, while Africa has 17% of the world’s population, 13% of its mobile connections and 5% of its broadband connections, it accommodates just 1% of the world’s data centre space, according to the Cisco Annual Internet report.

With more data centres on home soil, African businesses can access cloud services faster and more reliably, and African nations can also benefit from the by-product of enhanced connectivity for their citizens.

To understand why corporate initiatives to establish data centres in Africa are so vital for broader ICT connectivity, it’s important to consider the continent’s unique challenges and opportunities. Africa, with its diverse and vast landscape, is characterised by disparities in infrastructure development. While some regions boast advanced telecoms networks, others remain underserved or disconnected.

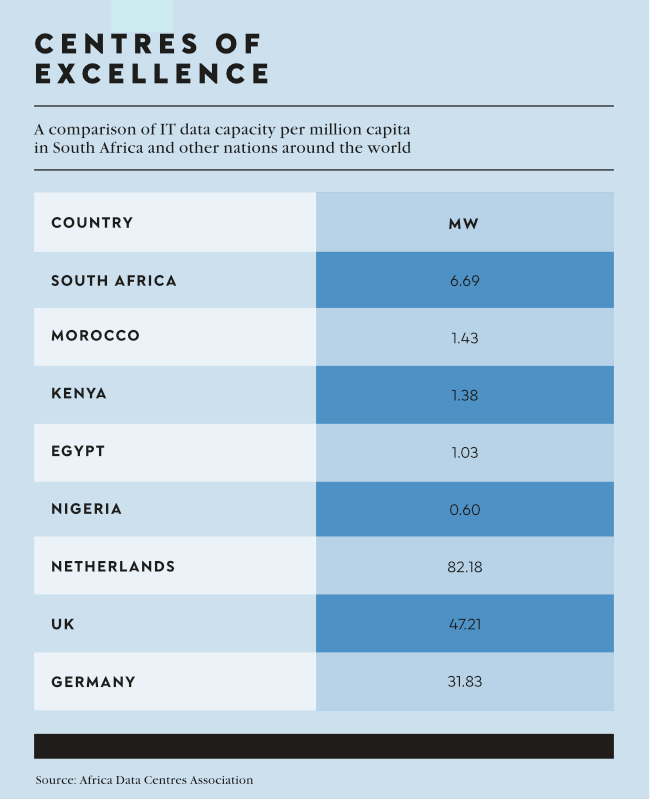

‘In Q1 2023, the five markets [South Africa, Nigeria, Kenya, Morocco and Egypt] mentioned [in the report] comprised more than 800 MW of total IT [data centre] power. This includes live and operational power as well as the development pipeline. It is important to note that South Africa accounts for over 408 MW of the total supply, with the majority of the western hyperscalers deploying in the market. Johannesburg and Cape Town are currently the only cities in Africa to have fully established cloud regions.’ That was from a report entitled Africa’s Key Data Centre Markets, among the latest research from the African Data Centres Association (ADCA).

Consultancy Xalam Analytics says about 70 new data centres were built in Africa between 2017 and 2022, and the continent’s ‘commercial hosting capacity is now doubling every three years’.

Africa’s data centre construction market was valued at US$763.7 million last year and is expected to reach US$1.4 billion by 2028, growing at a CAGR of 10.70% during that period, according to the Africa Data Centre Construction Market – Industry Outlook and Forecast report by Arizton Advisory.

In a webinar with Construct Africa, the chairperson of the ADCA, Ayotunde Coker, said ‘building out the intra-Africa fibre-optic network was also essential’; so too was ‘developing the digital infrastructure in the 17 countries that have not got a coast’. He added that ‘studies have shown that each 10% increase in broadband penetration translates into a 2% boost to GDP’.

Companies are taking the need to heart: Onix is building its new data centre in Dakar, Senegal, at the landing station of the 2Africa submarine cable. It will be powered mostly by renewable energy according to the company and is due to start operations in the first quarter of next year. Onix already operates a data centre in Accra, Ghana.

The West African country will also see another project developed soon – this one a 30 MW facility that will be a collaboration between Africa Data Centres and the US Development Finance Agency (DFA), which will see Africa Data Centres mobilise funds from the DFA’s existing US$300 million financing commitment to the region.

‘With a youthful and dynamic population, a government that provides support, and a thriving start-up ecosystem, Ghana is well-positioned to emerge as a prominent technology hub within the next five years,’ says Hardy Pemhiwa, president and CEO of Cassava Technologies, the parent company of Africa Data Centres, according to a report in Africa Business Communities.

Meanwhile, near the end of October, Raxio Data Centres, which operates in Uganda, Ethiopia, Mozambique, Côte d’Ivoire, the DRC, Angola and Tanzania, announced it had secured an additional US$46 million in equity funding. Earlier this year it ‘secured a facility’ of up to US$170 million of debt.

According to a company statement, the newly acquired funds will be strategically deployed to support Raxio’s expansion initiatives and facilitate the development of high-quality hyperscale-ready data centre facilities in leading African metro areas. ‘This investment marks a milestone achievement for Raxio,’ says Robert Mullins, its CEO.

‘This capital injection will allow Raxio to continue to expand its presence across the continent and to deliver the resilient mission critical environments that our customers are looking for.’

The company says it has designed and developed its facilities ‘across these key markets with a strong emphasis on, and long-term commitment to, sustainability across operations’. And that it is dedicated to ‘minimising the environmental footprint of facilities, by reducing energy and water consumption through efficient and innovative designs and equipment selection, and through supporting green initiatives’.

Environmental concerns are one of the key challenges facing new (and older) data centres across the continent. Chief among these is ensuring a reliable and sustainable power supply. Power outages and fluctuations can severely disrupt operations, potentially causing data loss and downtime for critical services. Also, the energy required to maintain these facilities is huge.

According to a recent study by the South African Data Centre Association, data centres in South Africa consumed about 2.37 TWh of electricity in 2022.

This accounts for close to 1.3% of the country’s total electricity consumption. One effective strategy data centre companies are adopting is investing in their own renewable energy sources.

In March this year, for example, African Data Centres signed a 20-year power purchase agreement with DPA Southern Africa for the supply of 12 MW of solar energy for its South African operations.

‘Each year, the data centre industry must try to accommodate two fundamental goals,’ says Tesh Durvasula, CEO of Africa Data Centres. ‘Firstly, it must meet the demand for the capacity needed to support the ever-increasing range of high-performance computing, digital services, edge environments and connected devices.’

Secondly, he says, ‘it must find ways to lower energy usage and reduce its universal impact resources that are already stretched to the limit’.

Africa Data Centres says it has a target to power all its data centres with clean, zero-carbon sources of energy. ‘This new deal will provide over 30% of our South African data centres with renewable energy, a great stride forward in our aim to reach carbon neutra-lity,’ says Durvasula. ‘By signing this latest PPA, we will reach our second milestone towards carbon neutrality. Our first milestone was to optimise our roof space with solar, and this latest deal will see us utilising the recently approved wheeling mechanism within South Africa’s municipalities.’

Other local data centre providers, among them Teraco, have also been proactive in addressing this concern. In January, Teraco, announced that it had secured a syndicated loan facility worth ZAR11.8 billion.

In a statement the company said the funding is ‘for the expansion of Teraco’s key interconnection hubs located within the Isando, Bredell and Cape Town campuses, and a significant renewable energy-generation programme aligned to the company’s long-term environmental, social and governance goals. Teraco’s new data centre builds are designed to put sustainability first, minimise environmental impact, reduce energy consumption and minimise water usage’.

The company has committed to powering its data centre colocation facilities with 50% renewable energy by 2027, and 100% by 2035. It will also maximise its combined rooftop solar footprint across its facilities to 6 MW by the end of 2023.

‘Teraco is dedicated to protecting, connecting and growing the enterprises and ecosystems shaping Africa’s digital future sustainably and responsibly,’ says Samuel Erwin, Teraco’s CFO. ‘As we continue our journey, our ESG goals form the cornerstone of how we grow our business, engage with employees and suppliers, support our clients and minimise our impact on the environment. We are committed to managing our environmental impact sustainably by optimising our use of energy and natural resources.

‘We remain focused on efforts to create energy-efficient data centres that address our environmental challenges, and we’re grateful for the continued support from partners that share our vision.’

Meanwhile, Niraj Shah, sales and business development director at IXAfrica Data Centre (IXADC), says renewable energy was a key factor for the location of its Nairobi-based data centre, as the Kenyan power grid comprises close to 93% renewable energy. IXADC is the largest carrier-neutral hyperscale facility of its kind in East and Central Africa.

‘Generating one’s own power is [also] a solution that would work when looking at colocation data centres that may be 1 MW to 2 MW, but with the advancement of digitalisation in Africa and cloud adoption on an uptake, hyperscale data centres are a focus of hypercloud providers. The power capacity for these DCs is multi-megawatt.

‘Using on-site power generation for data centres on a long-term basis is indeed a feasible option that many operators are exploring,’ he says, adding, however, that ‘regulations within countries also control the ability to generate one’s own power and so collaboration with government is essential, with the capability to have PPPs’.

The development initiatives undertaken by both local and international data centre companies are essential in expanding ICT connectivity across the continent. As data centres continue to proliferate in Africa, so too does the potential for businesses and individuals to reap the benefits of an increasingly connected world.