Africa’s fintech revolution started with mobile money service M-Pesa in Kenya 15 years ago and is now moving into a more established phase that offers huge growth potential and will see more partnerships with traditional banks. Fintech is the continent’s fastest-growing start-up industry, with Disrupt Africa listing 576 fintech start-ups across 25 countries in its 2021 Finnovating for Africa report. Countries such as Botswana and Liberia host just one venture, while the ‘big three’ – South Africa, Nigeria and Kenya – account for 67.9% of all fintech start-ups.

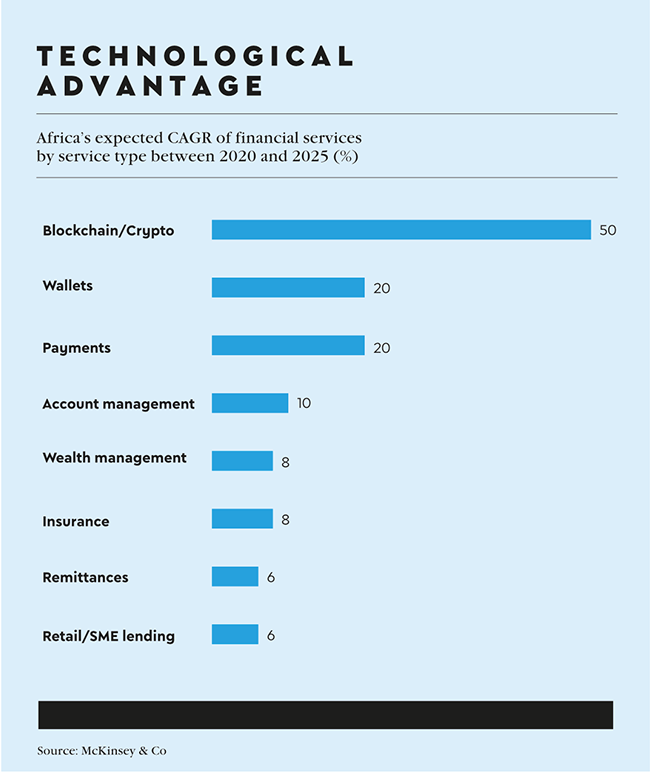

The fintech services on offer have evolved significantly since Safaricom introduced the cellphone-based M-Pesa peer-to-peer money transfer in 2007 – for the first time including those with limited or no access to formal banking. Blockchain, payments and wallets are predicted to be the fintech sectors likely to grow the fastest, according to a 2022 McKinsey & Co report, followed by account management; insurance; and wealth management; and eventually remittances; and retail or SME lending.

Fintech companies are making it their business to disrupt and augment traditional financial services, notes McKinsey’s Fintech in Africa report. Titled the End of the Beginning, it indicates that the fintech industry is coming of age and that company revenue could multiply by eight times its 2020 value – rocketing to US$30.3 billion by 2025.

‘African fintechs have already made significant inroads into the market, with estimated revenues of around US$4 billion to US$6 billion in 2020 and average penetration levels of between 3% and 5% (excluding South Africa),’ the report notes, calling African fintech ‘a hotbed for investment’.

It attributes this success to increasing smartphone ownership, declining internet costs and expanded network coverage, as well as a young, fast-growing and rapidly urbanising population.

M-Pesa is a textbook example of how a regional platform can use technology (in this case smartphones) to anticipate customer needs and flourish. Since its inception, the Vodafone-owned business has evolved into the continent’s largest fintech provider, serving more than 51 million customers and 465 000 businesses in seven African countries. The extraordinary success story involves 42 000 external developers who launched additional services for M-Pesa, ranging from utility bill payments and business payroll, to financial services such as micro-loans.

Initially, many financial institutions regarded fintechs as ‘unwelcome disruptors and even existential threats’, putting them on the defensive, reports business consultancy Deloitte. ‘Today, most companies have pivoted to more engaged and proactive collaboration. Many are looking not merely to keep up with how fintechs are changing the industry; they are looking to become major players in shaping, financing and utilising fintech to fuel their own reinvention and growth.’

In line with this, the number of traditional banks partnering with fintech firms in Africa is increasing. These are mutually beneficial, symbiotic relationships, according to John Elliott, head of fintech partnerships and innovation at Investec. ‘Incumbent institutions have fantastic client bases, trust, deep regulatory expertise and the balance sheet to be able to capitalise on market opportunities,’ he says. ‘Fintechs often have the luxury of focus on a single line of business, no technology legacy, a next-generation client experience, and an ability to move faster than an incumbent could. Putting the best of these two worlds together, banks can help fintechs access clients and scale, and put the appropriate regulatory guard rails in place; while the fintech can bring an enhanced client experience and product to the bank’s clients.’

McKinsey’s analysis reveals that fintech players are delivering significant value to their customers. ‘Their transactional solutions can be up to 80% cheaper and interest on savings up to three times higher than those provided by traditional players, while the cost of remittances may be up to six times cheaper.’ The consultancy says that together with an influx of funding and increasingly supportive regulatory frameworks, these factors could signify the beginning of exponential growth for African fintech markets, following the trajectory of more mature markets, such as Vietnam, Indonesia and India.

‘South Africa’s excellent regulatory environment, deep and liquid capital markets, and highly skilled engineers make it a great environment for fintech start-ups wanting to build a business,’ says Elliott.

‘Our clients are also seeing this. We have supported a number of clients in transactions as they invest in and participate in the fintech story. In turn, this becomes a major opportunity for wealth creation in our economies as these firms grow.’

He provides Adumo (online payment solutions), Finclusion (AI-powered lending), Yoco (mobile card machines) and Planet 42 (rent-to-buy car subscriptions) as examples of major double-digit million-dollar deals over the past year. ‘We believe that there is a lot of runway in front of the South African fintech story. We are seeing several industry veterans taking their expertise and experience into fintechs, addressing real-world problems and developing commercially viable solutions.’

Some fintech start-ups are providing solutions to problems that you may not even realise exist.

Mesh.trade, for example, recently entered the South African market to democratise capital markets, making it accessible to more countries, more companies and more people. The fintech is a financial markets infrastructure platform that uses blockchain to enable ordinary people (retail investors, corporates and SMEs), alongside institutional users (investment banks and fund managers), to issue and invest in both pure digital and digitalised financial assets.

From decentralised finance (DeFi) instruments and cryptocurrencies, all the way through to traditional financial assets, instruments such as exchange-traded funds, unit trusts, stocks, bonds and derivatives can be tokenised and fractionalised using the Mesh instrument builder, so clients can trade and settle them using the time and cost efficiencies, and cryptographic security delivered by blockchain. ‘We make capital raising and investment opportunities available to all market participants,’ says Connie Bloem, co-founder and MD of Mesh.

‘Technologies that fall under the DeFi banner – blockchain, yield tokens, smart contracts, instant settlement and the like – have the potential to create a revolution within the global financial system, significant enough to have captured the attention of regulators the world over.’

While Africa’s financial ecosystems and their regulators are at vastly different maturity stages, fintech is already changing the financial markets and people’s lives across the continent.

A handful of fintechs, such as Nigeria’s Flutterwave, transform into unicorns (those with a valuation of more than US$1 billion). Flutterwave provides a payment infrastructure for global merchants and payment service providers, and recently partnered with Standard Bank, enabling the bank to ‘meet clients on the digital platforms where they are shopping, socialising and doing business’. Standard Bank’s customers in Nigeria, Zambia, Tanzania, Uganda, Ghana, Mauritius, Côte D’Ivoire and Malawi will have access to e-commerce, card issuing, payments, USSD, collections, lending and ‘buy now, pay later’ capabilities through this partnership.

The bank supports the development of fintechs through its ongoing investment in the Founders Factory Africa. ‘We partner with early-stage fintech businesses to accelerate growth and fast-track change, as we believe that this model greatly improves selected entrepreneurs’ chances of success,’ says Sacheen Kala, head of Standard Bank’s Founders Factory partnership. ‘We define innovation in Africa as solving critical infrastructure gaps to deepen the financial rails that will empower the data necessary to provide value-added services. As part of this vision, we recognise that start-ups solve in innovative ways, whether this be alternative credit models, new liquidity pools, know-your-customer management, remittances or collaborating closely with regulators.’

As fintech matures, Africa’s traditional banks are set to enter partnerships with fintechs that will benefit everybody, as the founder of Flutterwave explained when he said, ‘fintechs and banks are not competitors but trusted partners, with the key focus being the customer’.