TymeBank, Yoco, Lulalend, PayShap – fintech brands are becoming as recognisable to consumers as the conventional financial institutions they intend to disrupt.

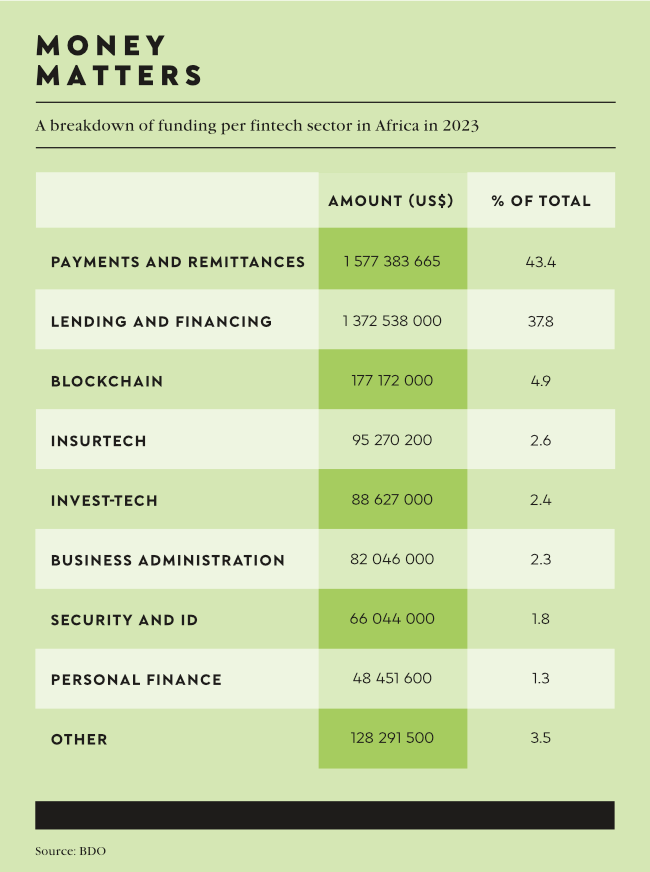

African fintechs raised US$1.55 billion in equity and debt funding last year. Afridigest points out that 75% of the US$900 million in equity deals went to only 10 companies – nine of them based in the big four fintech countries (South Africa, Nigeria, Egypt and Kenya).

While fintech is often touted as the answer to banking the unbanked, cash still appears to be king – notably in South Africa, the continent’s fintech leader. There fintech has been drafted in by traditional banks to broaden consumers’ access to cash as well as improving their own digital offerings.

The South African Reserve Bank’s (SARB) Payments Study Report released in September shows that cash payments make up 56% of all payments in South Africa, with most consumers accessing cash at ATMs (55%) or through cash-back services (28%) at a point of sale.

‘Even though the usage of cash is not growing any more, it remains the most popular payment method. Debit card usage is second and credit cards a distant third,’ SARB deputy governor Rashad Cassim told Business Day.

Cassim’s boss, SARB governor Lesetja Kganyago, believes South Africans are too reliant on cash. ‘I am proud of our cash – after all, my signature is on our banknotes. It is a symbol of trust, giving members of the public access to central bank money. [But] South Africans are over-reliant on cash. For most South Africans, cash is still king. People view it as easy to use and as the cheapest payment option available,’ he said at a payments conference at the beginning of October.

The SARB finding is backed up by consultancy BDO’s recent report – Unlocking potential, Fintech in Africa. It shows that although South Africa, as an emerging market, has a high banking penetration (more than 80%) and a high card penetration (more than 75% of adult consumers), consumers ‘are still underbanked and deal in cash, with only 30% stating they do more than three transactions per month’.

Although traditional banks are reducing their physical footprint, they are increasingly entering into partnerships with retailers to offer cash withdrawals at till points at participating retail stores.

Digital bank TymeBank, itself a fintech disruptor, has a growing presence in the real world, claiming that it offers face-to-face services to customers at more locations than traditional banks.

This year it has partnered with payments solutions provider Flash to enable customers to withdraw cash at more than 172 000 spaza shops and informal traders in South Africa. Customers can also withdraw cash from till points at 15 000 Boxer and Pick n Pay stores. The bank also has kiosks at more than 1 000 Pick n Pay, Boxer and the Foschini Group stores, where customers can open a regulation-compliant bank account in minutes.

TymeBank is one of the fintechs in the top 10 equity deals, securing US$78 million in equity funding in 2023.

Also in that top 10 list are South African payment innovators Peach Payments and Stitch, which scored US$31 million and US$25 million in equity deals respectively. The two fintechs are collaborating with banks – both of the traditional and digital variety – to enhance services.

Last year Peach partnered with Capitec to launch Capitec Pay, an open-banking app allowing online shoppers to make secure payments directly from their bank accounts. Peach EFT, meanwhile, enables its clients to offer point-of-sale EFT payments from most banks – including the big four (Absa, Standard, FNB and Nedbank), as well as Investec, Bidvest Bank and Old Mutual Bank.

Stitch’s pay-by-bank solutions allow bank customers to make payments directly from their bank account to any participating Stitch merchant. Stitch has also made its payments API available to Absa (AbsaPay), Capitec (Capitec Pay) and Nedbank (through its Direct API).

Stitch president Junaid Dadan says pay-by-bank is one of the fastest-growing payment methods in South Africa because of its seamless experience, speed and security. ‘This will continue to bring more consumers into the digital economy and give them more choice in how they want to make a payment,’ he says.

The payments sector is not the only fintech sector that’s bringing customers into the digital economy. Invest-tech makes up a small fraction (2.4%) of fintech VC funding in Africa, but it could make an out-sized contribution to helping Africans put their money to work. It is estimated that African banks hold almost US$90 billion… That’s a lot of money that can be re-invested.

Online trading broker Octa says one of its ‘core goals is to make trading accessible for everyone. We continuously explore innovative ways to create a personalised, seamless, and insight-driven experience for traders’.

AI-driven tools such as OctaVision have been incorporated into its services to provide tailored trading feedback and data-driven recommendations, ‘helping traders refine their strategies step by step’.

Its OctaTrader platform offers a one-stop solution that includes a dynamic feed for real-time analysis, collaborative tools and educational resources. ‘This approach empowers our users to make informed decisions and remain resilient to market fluctuations, ultimately creating a trading environment that is safe, supportive and responsive to each trader’s unique experience.’

It also employs ‘negative-balance protection’ to prevent clients from losing more than their initial investment, and pre-trading assessments ensure clients fully understand the risks before trading.

While fintechs are making banking – and trading – easier, whether they will replace traditional banking is another question.

Johan Gellatly, MD of Altron FinTech, doesn’t believe that fintech should be seen as direct competition to traditional banks. ‘Fintech companies offer innovative solutions that challenge certain traditional banking models in niche verticals where there is evidence of high consumer engagement and transactional friction,’ he writes in a recent online post.

Gellatly acknowledges that fintechs’ streamlined processes and digital-first approaches offer better agility and efficiency. But few fintechs can match ‘the breadth and depth of services offered by traditional banks’, he says.

‘Traditional banks are key to the success of fintechs and won’t disappear. We require traditional banks to evolve, innovate and grow, and partner with fintechs.’

In its fintech report, BDO ascribes the continued dominance of traditional banks in South Africa to the strict regulatory environment. ‘South African regulations require a merchant to have a specific financial services provider licence. In regions such as Kenya and Tanzania, they do not have regulations like this, and therefore the growth of their mobile money usage has skyrocketed in comparison.’

In addition to regulatory compliance, Gellatly includes among traditional banks’ advantages their ability to process large volumes of transactions, their physical geographic reach and resilience against cyberthreats. ‘By offering agnostic platforms and facilitating choice for consumers, fintechs enhance the financial ecosystem while leveraging the stability and resources offered by traditional banks,’ he says.

SARB governor Kganyago has acknowledged South Africa’s payment landscape needs to innovate, because while cash ‘might still be king’, its crown in slipping. He noted that last year total demand for banknotes and coins contracted 0.8%, the biggest fall since 1960.

Stemming from SARB’s Rapid Payments programme, automated clearing house BankServAfrica started rolling out PayShap, a low-value, real-time rapid payment platform in March 2023.

SARB said the service would at first be available through the big four banks, allowing transactions of up to ZAR3 000. Customers apply to their banks for a ShapID – a unique identifier, which enables customers to send or receive payments without sharing their banking details.

A year later, BankservAfrica data indicates more than 14 million PayShap transactions were made between March 2023 and February 2024, with a settlement value topping ZAR9 billion. The service has now been extended to African Bank, Discovery Bank, TymeBank, Capitec and Investec, among others.

As technology continues to innovate the financial sector, it’s clear that collaboration is the name of the game. To borrow an African proverb, ‘if you want to go fast, go alone. If you want to go far, go together’.

Images: Freepik