It had been coming since the start of the pandemic, and in May 2021 – just more than a year into South Africa’s national COVID-19 lockdown – the switch finally happened. After months of social distancing (no handshakes, no hugs), FNB confirmed that its customers’ contactless payments had surpassed chip and PIN contact payments for the first time.

‘This is a remarkable milestone for the financial services industry, and it augurs well for efforts to improve safety and convenience in the payments network,’ according to FNB payments executive Raj Makanjee. ‘We are delighted to see our customers pioneering what we believe to be the future of payments globally. It goes without saying that the pandemic has definitely accelerated the growth in contactless payments, as consumers and retailers continue to prioritise safety, convenience and efficiency.’

To be fair, ‘accelerated’ doesn’t do the trend justice. In March and April 2021 FNB’s card customers processed more than 30 million contactless payments (worth in excess of ZAR10 billion in each of those months), providing the tipping point to a 12-month growth path that saw the bank’s contactless payments recording anywhere between 200% and 400% year-on-year growth.

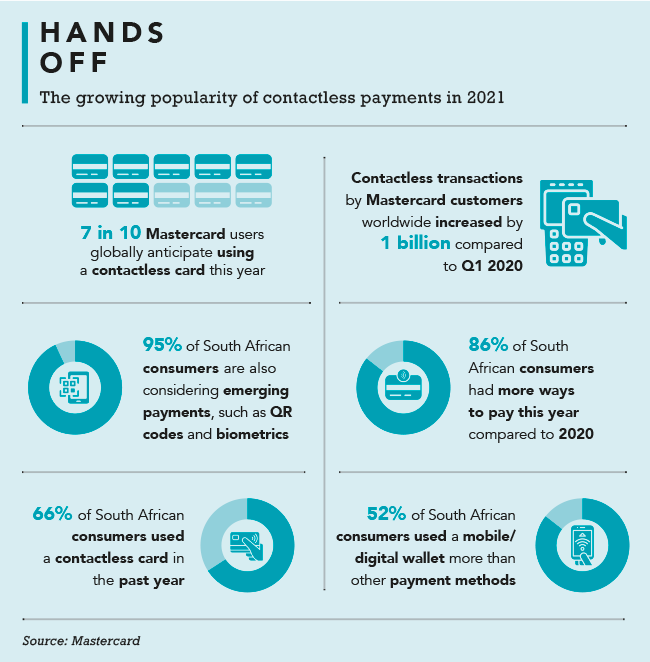

Makanjee is right, of course. While customers were already adopting tap-to-pay technology before the pandemic, COVID-19 pushed it well and truly into the mainstream. In Visa’s 2020 Back to Business survey, nearly half of consumers (48%) said they would not shop at a store that only offers payment methods that require contact with a cashier or shared machine such as a card reader. In the 2021 report, Visa notes that more than half (56%) of consumers had used contactless payments whenever possible in the past three months, making it the biggest shift in terms of shopping habits.

Aldo Laubscher, Visa South Africa country manager, believes this makes it critical for businesses to expand their acceptance methods beyond cash, and into contactless payment solutions such as Visa’s Tap to Phone mobile app, which launched in South Africa in May. ‘Tap to Phone is a quick, easy and secure way to pay that is perceptibly faster and more convenient than paying by cash,’ he says.

‘The experience is much swifter for consumers, especially as smartphones are quickly becoming commonplace. For merchants, tap-to-pay technology speeds up queueing times and reduces the burden of handling cash.’ Visa believes that, with billions of phones around the world at the ready, there’s an enormous opportunity that comes with – as the company puts it – ‘lighting them up as payment acceptance devices’.

Mastercard, with its Tap & Go solution, was already talking about all of this at the start of lockdown. ‘The act of buying everyday supplies such as eggs, toilet paper, medicine and other necessities has changed dramatically, with shoppers having to adjust to social distancing measures and other new challenges,’ Mark Elliott, division president of Mastercard, Southern Africa, said in April 2020. ‘According to a new Mastercard study, this shift in behaviour is particularly clear at checkout as people express a desire for contactless and voice concerns over cleanliness and safety at the point of sale.’

Back then, 69% of South African respondents to a Mastercard survey said contactless was their preferred payment method, with 71% adding that they preferred shopping at merchants that accepted contactless payments.

In September 2021, as if to confirm the shift, Hellopay’s SoftPOS won the Most Innovative Solution prize at the MTN Business App of the Year Awards. SoftPOS, a partnership with Mastercard, is a contactless acceptance solution that turns any Android device enabled with near-field communication (NFC) into a physical point of sale. A free app, it’s well suited for low-value transactions.

That’s good news for spaza-shop owners, market-stall traders and mobile servicemen, whose adoption of the technology is driving the contactless payment revolution. ‘Eliminating the need for a dedicated terminal and enabling the merchant to use their cellphone to accept card payments is revolutionary and a significant game-changer within the SMME sector,’ says Zunaid Miya, MD of Hello Group’s financial services business. ‘Lowering the barrier to entry for merchants to accept card payments is sure to result in a significant increase in the number of transactions settled via card.’

Andrew Dawson, MD of mobile payment software company MACmobile, agrees. He believes that while touchless payment has now become standard in the formal retail space, the next step would be to ‘conquer the informal sector’ where, he says, ‘cash is king’. Dawson outlines how technology providers are already providing the ‘push’ through services such as MTN’s Mobile Money or Telkom’s Yep. What’s needed next is the ‘pull’ in demand from the informal trading sector. ‘This boils down to education,’ he says. ‘We need to now educate, empower and create an environment where it’s not too costly to digitalise cash.

Andrew Dawson, MD of mobile payment software company MACmobile, agrees. He believes that while touchless payment has now become standard in the formal retail space, the next step would be to ‘conquer the informal sector’ where, he says, ‘cash is king’. Dawson outlines how technology providers are already providing the ‘push’ through services such as MTN’s Mobile Money or Telkom’s Yep. What’s needed next is the ‘pull’ in demand from the informal trading sector. ‘This boils down to education,’ he says. ‘We need to now educate, empower and create an environment where it’s not too costly to digitalise cash.

‘Historically, the infrastructure, software and support systems required from a banking perspective were expensive and there was little or no uptake as a result. Now, thanks to innovation from the banking and fintech sectors, there is a strong educational drive that will help make the change to move society to more of a cashless, digital environment.’

For this to succeed, he adds, it will be necessary to show retailers and the communities that support them the upside of being digitalised. ‘Without this buy-in at consumer level, including those grant recipients with their preference for cash, the responsibility still sits with the retailer or someone in the supply chain to digitalise that cash.’

Meanwhile, the formal sector is pushing on with its roll-out of contactless services. In India, proximity payments company ToneTag has linked up with Amazon to enable offline payments in stores using the e-commerce giant’s app. ToneTag uses sound waves to carry encrypted payment data, removing the need for NFC technology, an internet connection or even a smartphone (a basic feature phone does the job).

Before, as co-founder Kumar Abhishek, told Business Insider, ‘digital payments, transactions and commerce would happen via voice communication. We brought those two worlds together in a way that sound waves in the human voice can be used for inter-device communication. This could propel adoption of digital payments and commerce like never before’.

In Poland, food and beverage giant PepsiCo is piloting a touchless screen technology for use in fast-food restaurants, in response to concerns over hygiene. The screens, which PepsiCo is rolling out at KFC restaurants, use gestural interfaces that employ 3D hand-tracking technology. ‘We think this technology has great potential and we are now considering next steps for further pilots as we assess the results,’ Mia Sorgi, director of digital product and experience at PepsiCo Europe, told FoodIngredientsFirst. ‘For example, we are currently very interested in its potential for kerbside and drive-through customers.’

Based on that, it’s not hard to imagine a world where customers walk into a store or restaurant, place their orders by waving their hands in front of a screen, and then pay for their purchases either by a tone on their phones or via a contactless mobile payment app. The days of money physically changing hands are history.

Deloitte says as much in its most recent Contactless Economy report. ‘We believe that the single-most important factor that differentiates this crisis from the previous ones is the rise of the contactless economy,’ it states. ‘The contactless economy has been driven by both supply-side (eg rise of the digital technologies such as 5G, cloud platforms, AI and data analytics) and demand-side factors (eg need for convenience, heightened awareness for health and safety). Some of these existed previously but were accelerated due to the crisis.’

That’s despite a finding in a separate Deloitte survey in which 56% of respondents expressed the need for ‘more human touch in their digital experiences’. The irony is not lost on them: Deloitte’s report authors predict that ‘the lack of connection with contactless interactions could lead to a build-up of “experience debt” and user alienation. This is leading to a rise of human-centric platforms that can bring a more human experience into consumers’ digital lives’.

Better shopping experiences in safer, more hygienic environments? Suddenly, it doesn’t sound out of touch to say that.