Take some sunshine, add some gusts of wind, and you have the basic ingredients for one of Africa’s toughest procurement auctions. It’s a competition in which the bidders cut their margins to the bone to win 20-year government contracts to generate renewable energy and feed it into the national electricity grid. Unlike fossil fuels, these energy resources are free, environmentally friendly, and will not run out.

The continent’s abundant solar radiation is attracting interest, domestically, and most recently also from European countries seeking to replace their dependency on Russian gas with renewables. ‘South Africa’s higher-than-average solar radiation levels range between 4.5 kWh/m2 and 6.5 kWh m2 in a day, giving us a clear competitive advantage in pursuing solar PV options,’ says Nicola Rump, principal environmental scientist at SRK Consulting, an engineering and scientific consulting firm for the resource industry. ‘Our annual 24-hour global solar radiation average of about 220 W/m2 puts us well ahead of the United States with their 150 W/m2, and the level of about 100 W/m2 for Europe and the United Kingdom.’

This provides ideal conditions for South Africa’s Renewable Energy Independent Power Producer Procurement (REIPPP) programme, which is one of the world’s most stringently regulated and securely managed programmes of its kind. It has been hailed as a blueprint for renewables procurement in Africa. To date, the REIPPP has attracted about ZAR260 billion in investment in five bidding rounds since its inception in 2011. The bid selection is based on an evaluation system that allocates 90% to price and 10% to BEE scores, which is meant to promote black shareholding, job creation, women’s empowerment and local content. The latest bid round in 2021 committed ZAR2.7 billion towards socio-economic development and enterprise and skills development initiatives over the 20-year project lifetime.

The REIPPP’s Bid Window (BW) 5 was nearly four times oversubscribed and the tariffs for renewable power dropped to their lowest ever level (34.4c/kWh for the lowest onshore wind bid and 37.5c/kWh for the lowest solar PV bid). In the decade between the first and the fifth bidding rounds, the price fell by about three-quarters (68% for wind and 88% for solar), according to Green Cape’s 2022 Large-scale Renewable Energy Market Intelligence report. Consequently, the average internal rate of return for the selected bidders has also dropped (to 11.35% for BW 5 from 17.27% in BW 4 and higher in previous windows).

In October 2021, the tightly managed BW 5 evaluation process saw the announcement of 25 preferred bidders (12 solar PV and 13 onshore wind) with a total investment of more than ZAR50 billion. These projects will create nearly 1 000 MW of solar and 1 600 MW of wind energy, and are contractually obliged to become operational within two years after their commercial close. In addition to wind and solar PV, previous REIPPP rounds also procured large-scale concentrating solar power (CSP), small hydro, biomass and landfill gas. BW 6 was again inviting IPPs to increase solar PV and onshore wind energy capacity, with the bid window closing for submissions on 11 August 2022. Furthermore, there is great urgency to expand South Africa’s renewable-energy storage – or battery – capacity to supplement the constrained national power grid.

‘More investment in grid infrastructure is a critical requirement to ensure participation by cheaper renewable projects in future, especially in those areas with higher solar radiation yield,’ according to the Department of Mineral Resources and Energy when announcing the preferred bids of BW 5. ‘A positive development for the future is, however, that a total of eight projects were selected in the Free State province, and the first renewable onshore wind project in KwaZulu-Natal [was] also selected, as preferred bidders through this bid round. This promising trend indicates that the procurement of IPPs could very likely in future shift to other provinces, while the medium-term challenges around grid capacity development in other areas are addressed.’ Unfortunately, there were no preferred bidders in the main coal-producing province, Mpumalanga, where the economy needs significant support to transition the existing skills and jobs from fossil fuels towards a low-carbon future. All potential bidders from the Northern Cape and some from the Western Cape were excluded from BW 5, because there simply wasn’t enough infrastructure to connect to Eskom’s grid in their provinces.

South Africa is in a bizarre situation where Eskom’s worsening power blackouts – load shedding – are crippling the economy, while desperately needed electricity is going to be wasted, because some new renewables projects are designed to generate surplus energy that cannot yet be fed into the national grid due to capacity constraints. And the surplus energy can’t be stored because the battery systems are not yet in place either.

Incidentally, the destructive load shedding of 2021 could have been averted, if government hadn’t put the REIPPP on hold for six years, according to a new report by Meridian Economics. If 5 000 MW of additional renewable energy (roughly the amount raised during two REIPPP bid windows) had become available as planned, 96.5% of load shedding would not have been necessary last year.

The three latest solar PV and battery projects – by Norwegian renewable energy company Scatec in Kenhardt, Northern Cape – were established as part of an emergency tender to reduce South Africa’s energy-supply gap during the disrupted years before the REIPPP’s restart in 2021. It took until June 2022 for Eskom to sign its 20-year power purchase agreement (PPA) with Scatec under the emergency initiative, known as the Risk Mitigation Independent Power Producer Procurement (RMIPPP) programme.

‘There will be many days when these Scatec solar projects produce surplus electricity and RMIPPP contracts are designed in such as way that surplus electricity will be curtailed/wasted,’ said Anton Eberhard, a professor and prominent South African energy policy and investment adviser, after the PPA signing. ‘In order for the three South African Scatec solar and battery projects to meet their everyday contracted dispatch requirement of 150 MW between 5 am and 9.30 pm, they had to massively oversize their solar PV arrays. Most days they will end up curtailing surplus energy. We should be optimising the power system as a whole, not at individual plant level.’

His fellow academic, Lwazi Ngubevana, who is the director of the African Energy Leadership Centre at Wits Business School, also calls for a more integrated approach – and a pan-African vision. ‘As Africans, we need to take stock of what we have as Africa, and that it is critical for us to be cognisant of our potential,’ he says.

‘Currently a more co-ordinated regional and continental wide point of view is non-negotiable. Enablement of an agreed vision may necessitate political intervention because if you cannot guarantee political stability, you cannot guarantee investment.’

And yet investment is desperately needed. According to the International Energy Agency, COVID-19 plunged an additional 25 million people in Africa into energy poverty, leaving more than 600 million (43% of the continent’s population) without access to electricity. In its newly released African Energy Outlook 2022, the agency says that renewables, including solar, wind, hydroelectric and geothermal power, could provide 80% of the new generating capacity required by 2030. It would take an investment of US$25 billion annually (a sum equivalent to about 1% of total global energy investment) to achieve universal energy access in Africa.

In South Africa, coal continues to dominate energy production, providing 81.4% of the total system load, says the Centre for Scientific and Industrial Research. ‘The contribution of renewable-energy technologies – wind, solar PV and CSP – increased in 2021 to a total of 5.7 GW installed capacity and provided 6.6% of the total energy mix.’ The pressure to increase renewables capacity is mounting from all sides – to ensure an end to load shedding for businesses, to provide affordable energy for citizens, and to create green jobs as well as to reduce carbon emissions in line with global climate commitments. This transition can still be achieved.

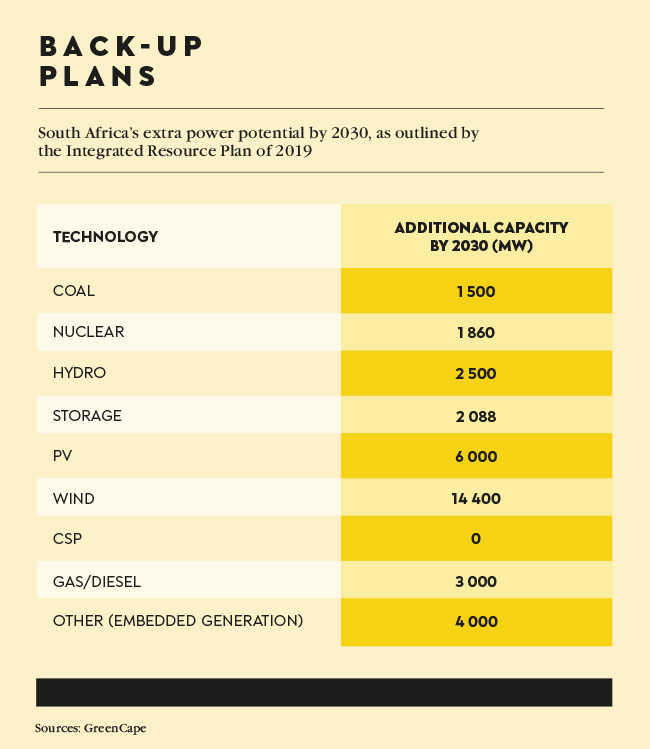

For example, Meridian Economics suggests pathways out of the energy crisis – beginning with a revision of South Africa’s Integrated Resource Plan, which sets out the energy mix until 2030 but is already outdated. Government, Eskom and the private sector will have to work together to find solutions and speed up the processes. On the upside, the country has a strong corporate pipeline of renewables projects that are ready to go ahead, as well as its sophisticated public procurement programme, the REIPPP. Both of these serve as a shimmer of hope that could show the way for South Africa and possibly other African nations too.