‘At first glance, it would seem that the gas and oil industry is merely part of the climate problem – but it will also be part of the solution.’ That was Dawn Summers, CEO of German oil and gas producer Wintershall DEA, writing in an online opinion piece at the end of last year.

It could certainly be a solution for Africa, where gas is being heavily touted as a transition fuel in its drive towards achieving universal access to clean, affordable energy, as enshrined in the UN’s Sustainable Development Goal 7.

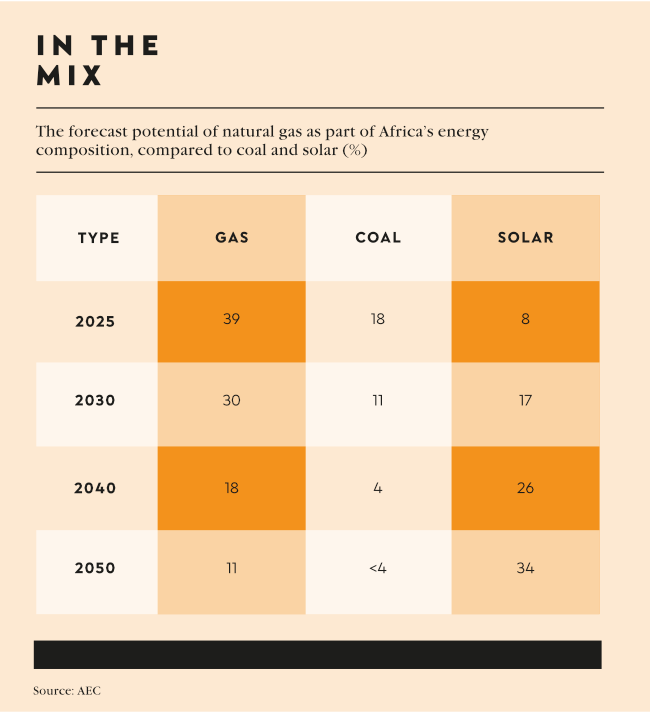

According to the Africa Energy Chamber’s (AEC) State of African Energy 2024 Outlook report, released in December 2023, while the role of natural gas in energy supply will gradually decrease over the years, it is still expected to account for 10% of power generation on the continent in 2050, down from 30% in 2030 and 20% in 2040.

In line with this, SADC signed off on a US$17 billion African gas infrastructure pact in August 2023. The region’s nascent gas industry has been boosted by recent major gas discoveries, particularly in the Orange basin off the west coast of Southern Africa, while gas projects off Mozambique are being restarted after long delays. The bloc argues that ‘SADC member states have growing populations and an urgent need to drive inclusive economic growth, reduce poverty and income inequality, and create prosperity and well-being for all’. It sees gas complementing renewable energy, ‘expediting the development of the power grid in renewable resource-rich areas’.

The 15-year SADC plan will see a co-ordinated approach to developing gas infra-structure in the region, such as pipelines and import terminals. While funding still has to be nailed down, almost half of the total projected investment – US$9 billion – has been earmarked for Mozambique, leveraging its significant discoveries in the north.

Mozambique is ranked 14th in the world in terms of natural gas reserves with 100 trillion cubic feet (tcf), but ranks 55th in terms of production, according to Worldometer. Development of its gas industry, slowed down by security threats, is now showing signs of new life.

In November 2022, ENI’s Coral South – Mozambique’s first offshore natural gas exploration and, at 2 000m, the world’s deepest floating natural gas project – exported the first natural gas produced from the well, under a long-term purchase and sale contract with BP. In addition, a final investment decision on ENI’s second Coral South project is expected later this year. And following years of delays, TotalEnergies is planning to restart its US$20 billion liquefied natural gas (LNG) project off the coast of Cabo Delgado any moment now, with hopes to launch commercial production in 2028. However, ExxonMobil’s long-awaited Rovuma LNG project – with a production capacity of 15.2 million tons per annum – is still to get out the starting gate.

Mozambique is also one of the gas-producing countries on the continent – along with Nigeria, Algeria, Egypt, Equatorial Guinea and Mauritania – that the AEC is pinning its hopes on in terms of meeting gas demand from Europe, still suffering the consequences of Russia’s invasion of Ukraine and the ongoing war there. The AEC says the continent is ‘at a point where it can benefit from historical gas trade relations with Europe, existing infrastructure to export gas to Europe, geographical vicinity to the demand centres and most importantly abundant natural gas potential. It is very important that both the upstream operators and policymakers grasp this opportunity with both hands and solidify Africa’s role as a global natural gas exporter before the opportunity diminishes or, even worse, expires’.

The SADC plan though is mostly concerned with securing the continent’s own energy supply through gas, relying heavily on South Africa’s adoption of gas-to-power technologies in its energy policy. Gas was revealed as a prominent feature of South Africa’s most recent Integrated Resource Plan (IRP). Of the 15 403 MW of new power generated allocated to wind, solar and gas in the draft IRP 2023, almost half (7 220 MW) has been assigned to natural gas. ‘Gas-to-power technologies will provide the flexibility to complement renewable energy. In the short term, gas import options should be pursued while local exploration is undertaken,’ according to the IRP 2023.

South Africa relies mostly on Mozambique for its natural gas, but the much-trumpeted discoveries in 2019 and then in 2020 in South African waters at the Brulpadda and Luiperd fields in the Outeniqua basin off the southern coast have changed all this. AEC executive chair NJ Ayuk says that when the fields come online, ‘their cumulative average output is estimated to be around 35 000 barrels per day of liquids and about 100 000 barrels of oil equivalent per day of natural gas’.

Things are moving along, with commercial operation pencilled in for 2026. The US$2 billion project, led by France’s TotalEnergies, is in the approval stage, with the final investment decision expected this year. The Department of Forestry, Fisheries and the Environment has also given the French multinational the go-ahead to drill five exploration wells between Cape Town and Cape Agulhas in a licence area of 10 000 km2, with work scheduled to start early this year.

Meanwhile, work on the E-BK conventional gas field – in shallow waters in the Bredasdorp basin off Mossel Bay – is in the design phase. Discovered in 2015 and operated by state-owned PetroSA, the gas field is expected to start commercial production this year, peaking in 2025. The field is expected to reach its economic limit in 2038.

Most of the recent action in the Southern Africa region is happening off the west coast in the Orange basin. In Block 2A, South Africa’s largest independently developed gas project – the Ibhubhesi conventional gas field (an estimated 8 tcf of reserves) – is expected to start commercial production in 2025. The US$1.14 billion project, led by South Africa’s Sunbird Energy, will involve the drilling of 14 wells as well as the construction of a floating production storage and offloading (FPSO) unit, a subsea manifold, subsea tree and tension leg platforms. The FPSO is expected set the stage for the export of gas.

Also in the Orange basin in Block 3B/ 4B, a seismic survey by RISC Advisory for Canada’s Africa Oil has discovered an estimated 4 billion barrels of oil equivalent and up to 24 prospective natural gas plays.

In addition to the drilling off South Africa, activity off Namibia has been described in the media as ‘white hot’. ‘White hot’ is right. As recently as January 2024, Portugal’s Galp Energia announced it had made a ’significant’ light-oil discovery. This comes less than two months after it began drilling, in November 2023, with its first well, Mopane, indicating the presence of hydrocarbons (oil and natural gas).

Namibia’s hydrocarbon bonanza started in 2022 when TotalEnergies made a significant discovery of light oil with associated gas on the Venus prospect. Then last year, Shell made significant hydrocarbon discoveries at four drill sites – Lesedi, Graff, La Rona and Jonker sites.

Namibian Minister of Energy Isak Katali announced late last year that he expected that ‘six to eight wells to be drilled in Namibia’s waters in the next 18 months, the highest number in Namibia’s exploration history’. He said recent findings could ‘turn offshore Namibia into a great producer of oil and gas in a short time’.

A number of projects are on the go onshore in South Africa as well. In addition to Renergen’s Virginia gas field in the Free State, where natural gas and helium are already being extracted, the Amersfoort coalbed methane field development in Mpumalanga is expected to start commercial operation in 2024. Owned by Australia’s Kinetiko Energy through its local subsidiary Afro Energy, the project will see the gas power a containerised generator, which will be integrated into the national power grid. The project will initially target 1 MW of output, with additional phases increasing output to 50 MW.

Kinetiko announced in August last year that exploration at an adjoining site, ER 271, has resulted in an understanding with the Industrial Development Corporation to develop the 2 tcf Korhaan gas project, to ultimately deliver up to 500 MW of gas to power, again through a phased approach.

According to the Daily Maverick, the company has applied for a production rights at ER271, which the company expects in about a year.

Kinetiko CEO Nick de Blocq told the publication that the company had ‘41 holes in the ground across all three of our current rights areas and so far we have had a 100% strike rate, so we have 41 boreholes, 41 gas strikes, and I’m calling a world record on that unless somebody corrects me’.